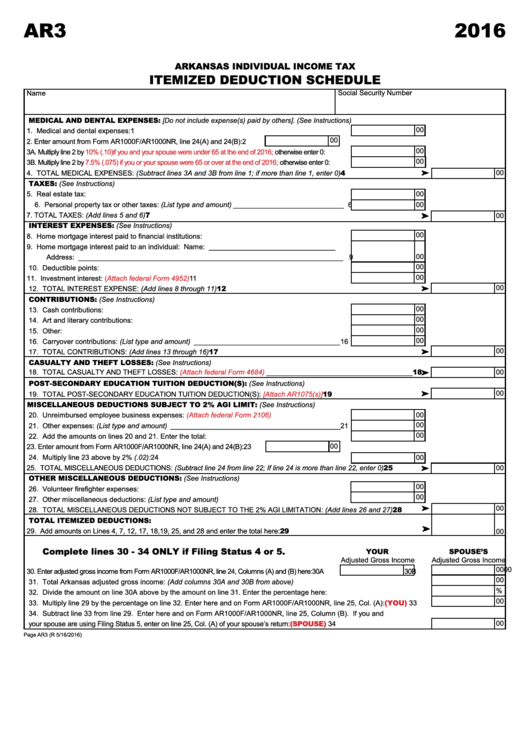

Form Ar3 - Itemized Deduction Schedule - 2016

ADVERTISEMENT

AR3

2016

ARKANSAS INDIVIDUAL INCOME TAX

ITEMIZED DEDUCTION SCHEDULE

Social Security Number

Name

MEDICAL AND DENTAL EXPENSES: [Do not include expense(s) paid by others]. (See Instructions)

00

1. Medical and dental expenses: .......................................................................................................... 1

00

2. Enter amount from Form AR1000F/AR1000NR, line 24(A) and 24(B): .....2

00

3A. Multiply line 2 by

10% (.10) if you and your spouse were under 65 at the end of 2016;

otherwise enter 0: .......3A

00

3B. Multiply line 2 by

7.5% (.075) if you or your spouse were 65 or over at the end of 2016;

otherwise enter 0: .... 3B

4. TOTAL MEDICAL EXPENSES: (Subtract lines 3A and 3B from line 1; if more than line 1, enter 0).....................................4

00

TAXES: (See Instructions)

5. Real estate tax: ................................................................................................................................ 5

00

6. Personal property tax or other taxes: (List type and amount) ____________________________ 6

00

7. TOTAL TAXES: (Add lines 5 and 6) .......................................................................................................................................7

00

INTEREST EXPENSES: (See Instructions)

00

8. Home mortgage interest paid to financial institutions: ...................................................................... 8

9. Home mortgage interest paid to an individual: Name: ________________________________

00

Address: ___________________________________________________________________ 9

00

10. Deductible points: ........................................................................................................................... 10

00

11. Investment interest:

(Attach federal Form 4952)

............................................................................ 11

00

12. TOTAL INTEREST EXPENSE: (Add lines 8 through 11) ................................................................................................... 12

CONTRIBUTIONS: (See Instructions)

00

13. Cash contributions: ......................................................................................................................... 13

00

14. Art and literary contributions: .......................................................................................................... 14

00

15. Other: ............................................................................................................................................. 15

00

16. Carryover contributions: (List type and amount) _____________________________________ 16

00

17. TOTAL CONTRIBUTIONS: (Add lines 13 through 16) ....................................................................................................... 17

CASUALTY AND THEFT LOSSES: (See Instructions)

_____________________________________ 18

18. TOTAL CASUALTY AND THEFT LOSSES:

(Attach federal Form 4684)

00

POST-SECONDARY EDUCATION TUITION DEDUCTION(S): (See Instructions)

00

............................................ 19

19. TOTAL POST-SECONDARY EDUCATION TUITION DEDUCTION(S):

[Attach AR1075(s)]

MISCELLANEOUS DEDUCTIONS SUBJECT TO 2% AGI LIMIT: (See Instructions)

20. Unreimbursed employee business expenses:

(Attach federal Form 2106)

.................................... 20

00

00

21. Other expenses: (List type and amount) ___________________________________________ 21

00

22. Add the amounts on lines 20 and 21. Enter the total: .................................................................... 22

00

23. Enter amount from Form AR1000F/AR1000NR, line 24(A) and 24(B): .... 23

24. Multiply line 23 above by 2% (.02): ................................................................................................ 24

00

25. TOTAL MISCELLANEOUS DEDUCTIONS: (Subtract line 24 from line 22; If line 24 is more than line 22, enter 0) ............. 25

00

OTHER MISCELLANEOUS DEDUCTIONS: (See Instructions)

00

26. Volunteer firefighter expenses: ....................................................................................................... 26

00

27. Other miscellaneous deductions: (List type and amount) .............................................................. 27

00

28. TOTAL MISCELLANEOUS DEDUCTIONS NOT SUBJECT TO THE 2% AGI LIMITATION: (Add lines 26 and 27) .......... 28

TOTAL ITEMIZED DEDUCTIONS:

29. Add amounts on Lines 4, 7, 12, 17, 18,19, 25, and 28 and enter the total here: .....................................................................29

00

Complete lines 30 - 34 ONLY if Filing Status 4 or 5.

YOUR

SPOUSE’S

Adjusted Gross Income

Adjusted Gross Income

00

00

30. Enter adjusted gross income from Form AR1000F/AR1000NR, line 24, Columns (A) and (B) here: ...... 30A

30B

00

31. Total Arkansas adjusted gross income: (Add columns 30A and 30B from above) ...................................................................31

%

32. Divide the amount on line 30A above by the amount on line 31. Enter the percentage here: ..................................................32

00

(YOU)

33. Multiply line 29 by the percentage on line 32. Enter here and on Form AR1000F/AR1000NR, line 25, Col. (A): .......

33

34. Subtract line 33 from line 29. Enter here and on Form AR1000F/AR1000NR, line 25, Column (B). If you and

(SPOUSE)

00

your spouse are using Filing Status 5, enter on line 25, Col. (A) of your spouse’s return: ............................................

34

Page AR3 (R 5/16/2016)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1