Nebraska State Treasurer’s Office

Unclaimed Property Division

5800 Cornhusker Hwy, Bldg. 2 Ste. 4,

809 P Street

Lincoln, NE 68507

Lincoln, NE 68508-1390

Holder Report for Unclaimed Property

Please review your records to determine if you have any of the items on Form UP-1 (on page 2). If you do have property to

report, please provide all of the owner information you have including social Security number, date of birth and last known

address.

If you have any questions or need assistance in completing the forms, please do not hesitate to contact us at 402.471.8497.

Respectfully,

Shane Osborn

Nebraska State Treasurer

Instructions for Complying with Nebraska`s Disposition of Unclaimed Property Act

•

If you have nothing to report, it is not necessary to return this form, but a negative report will be accepted if submitted.

•

Reports and remittance are to be filed each November 1st for the year ending the preceding June 30th. Life insurance

corporations must file by May 1st for the year ending the previous December 31st.

•

Remittance must accompany report. Make check payable to the State of Nebraska. The aggregate amount for Nebraska is

under $25

•

Nebraska`s Dormancy period for holders is five years for all property with the following exceptions:

1 year for payroll

3 years for gift certificates

3 years for court/public corporation funds

2 years for dissolutions

3 years for Utility deposits

7 years for money orders

2 years for demutualization proceeds

3 years for mineral proceeds

15 years for travelers checks

•

All securities must be registered in the street name ``STANEB.``

•

All reports with more than 5 property owner names must be submitted via disk in HRS Pro format. Please visit

for free software.

•

A holder may pay or deliver property before the property is presumed abandoned if all due diligence requirements are met.

WHO MUST REPORT

c) if a single item has two or more owners, the names and addresses of both must

be shown along with the relationship (e.g., ``Trustee for``, ``or``, ``and``, ``Cust. for

Any holder of property belonging to another person when the owner has not claimed

_____ UGMA-NE``, etc.)

it, or if correspondence with the holder had been unsuccessful and returned in the

mail.

d) List the complete address, including the zip code

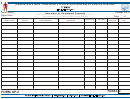

HOW TO REPORT (Report form UP-2)

e) When reporting certified or cashier`s checks, list the names and addresses of

both the remitter and payee, specifying each. In the case of money orders and

This form is used to report individual items of unclaimed property. The report is to be

travelers checks, only the identification number is required.

completed and mailed with the UP-1 by November 1 (Mat if you are a life insurer).

The property which is to be reported includes the list on UP-1. Please provide as

COLUMN 4: Enter the owner’s social security of Federal ID number and date of birth

much identifying information as you can.

if known

REPORT YEAR: Enter the year-end dates. June 30 for everyone except life insurers

COLUMN 5: The ``date of customer`s last transaction`` is that of the last deposit or

(December 31).

withdrawal made by the owner

COLUMN ENTRIES:

COLUMN 6: List the amount due the owner. This includes all interest earned on

deposits through November 1 of the reporting year (service charges are listed in

COLUMN 1: Enter the property description of each item. If possible, use the

column 7). In the case of stocks and bonds, the number of shares should be listed.

descriptions listed on UP-1.

For all safe deposit box contents or other safekeeping depositories, copies of the

notarized inventories of the contents must be attached as part of the report. The

COLUMN 2: Enter the ID number of the property, such as account number, policy

report should be sent separately form the contents.

number and similar items.

COLUMN 7: If service charges, deductions, withholdings, or discontinued interest

COLUMN 3:

payments have been made, the holder shall include or attach a copy of the contract

a) List in alphabetical order last name, first name and middle initial or name if

authorizing such charges or discontinues payments. The amount of service charges

available. Be sure to include information which would aid in identification such as Jr.,

deducted form each item should be entered in. When service charges equal or

Sr., Miss, Dr., etc. after the middle name.

exceed the value of the property, this information must be reported.

b) Corporate title and the like should be entered exactly as adopted.

COLUMN 8: Enter the amount due the owner. Enter the column totals at the bottom

of each column. If your report is longer than one page, enter the grand totals for the

entire report on the last page submitted with the report.

Nebraska State Treasurer Shane Osborn | | 402.471.8497 | 809 P Street, Lincoln, NE, 68508-1390

Nebraska State Treasurer Shane Osborn | | 402.471.8497 | 5800 Cornhusker Hwy, Bldg. 2 Ste. 4, Lincoln, NE 68507

809 P Street, Lincoln, NE, 68502

809 P Street, Lincoln, NE, 68508-1390

1

1 2

2 3

3 4

4 5

5