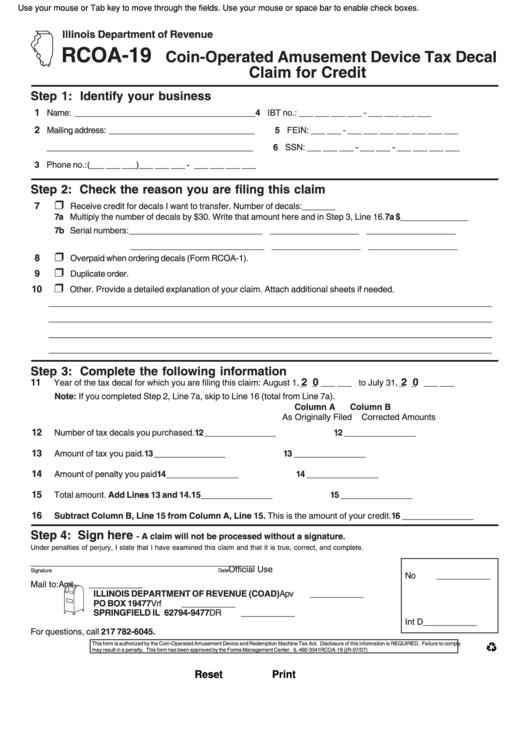

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

RCOA-19

Coin-Operated Amusement Device Tax Decal

Claim for Credit

Step 1: Identify your business

1

Name: ________________________________________

4 IBT no.: ___ ___ ___ ___ - ___ ___ ___ ___

2

Mailing address: ________________________________

5 FEIN: ___ ___ - ___ ___ ___ ___ ___ ___ ___

______________________________________________

6 SSN: ___ ___ ___ - ___ ___ - ___ ___ ___ ___

3 Phone no.:(___ ___ ___)___ ___ ___ - ___ ___ ___ ___

Step 2: Check the reason you are filing this claim

❒

7

Receive credit for decals I want to transfer. Number of decals:_______

7a Multiply the number of decals by $30. Write that amount here and in Step 3, Line 16.

7a $_______________

7b Serial numbers: __________

__________ __________ __________ __________ __________ __________

__________

__________ __________ __________ __________ __________ __________

❒

8

Overpaid when ordering decals (Form RCOA-1).

❒

9

Duplicate order.

❒

10

Other. Provide a detailed explanation of your claim. Attach additional sheets if needed.

___________________________________________________________________________________________________

___________________________________________________________________________________________________

___________________________________________________________________________________________________

___________________________________________________________________________________________________

Step 3: Complete the following information

2 0

2 0

11

Year of the tax decal for which you are filing this claim: August 1,

___ ___ to July 31,

___ ___

Note: If you completed Step 2, Line 7a, skip to Line 16 (total from Line 7a).

Column A

Column B

As Originally Filed

Corrected Amounts

12

Number of tax decals you purchased.

12________________

12 ________________

13

Amount of tax you paid.

13________________

13 ________________

14

Amount of penalty you paid

14________________

14 ________________

15

Total amount. Add Lines 13 and 14.

15________________

15 ________________

16

Subtract Column B, Line 15 from Column A, Line 15. This is the amount of your credit.

16 ________________

Step 4: Sign here

- A claim will not be processed without a signature.

Under penalties of perjury, I state that I have examined this claim and that it is true, correct, and complete.

__________________________________________________

Official Use

Signature

Date

No

____________

Mail to:

Amt

____________

ILLINOIS DEPARTMENT OF REVENUE (COAD)

Apv

____________

PO BOX 19477

Vrf

____________

SPRINGFIELD IL 62794-9477

DR

____________

Int D

____________

For questions, call 217 782-6045.

This form is authorized by the Coin-Operated Amusement Device and Redemption Machine Tax Act. Disclosure of this information is REQUIRED. Failure to comply

RCOA-19 ((R-07/07)

may result in a penalty. This form has been approved by the Forms Management Center.

IL-492-3341

Reset

Print

1

1