Property Tax Exemption Request Template - City Of Battle Creek, Michigan

ADVERTISEMENT

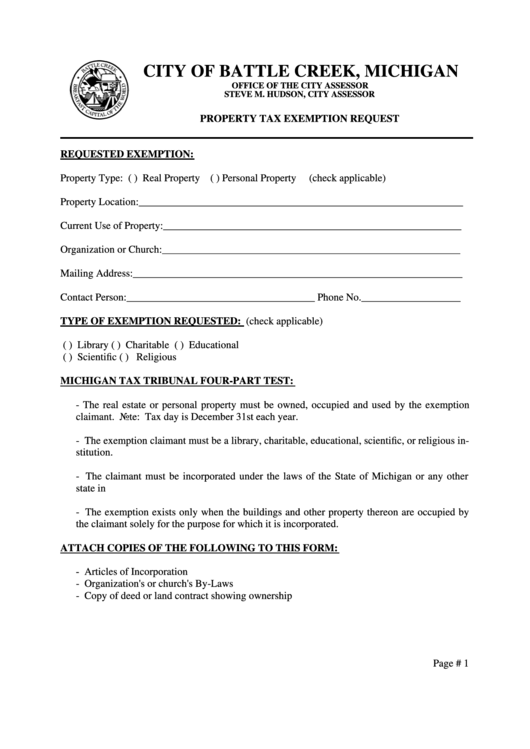

CITY OF BATTLE CREEK, MICHIGAN

OFFICE OF THE CITY ASSESSOR

STEVE M. HUDSON, CITY ASSESSOR

PROPERTY TAX EXEMPTION REQUEST

REQUESTED EXEMPTION:

Property Type: ( ) Real Property ( ) Personal Property

(check applicable)

Property Location:______________________________________________________________

Current Use of Property:_________________________________________________________

Organization or Church:_________________________________________________________

Mailing Address:_______________________________________________________________

Contact Person:____________________________________ Phone No.___________________

TYPE OF EXEMPTION REQUESTED: (check applicable)

( ) Library

( ) Charitable

( ) Educational

( ) Scientific

( ) Religious

MICHIGAN TAX TRIBUNAL FOUR-PART TEST:

- The real estate or personal property must be owned, occupied and used by the exemption

claimant. Note: Tax day is December 31st each year.

- The exemption claimant must be a library, charitable, educational, scientific, or religious in-

stitution.

- The claimant must be incorporated under the laws of the State of Michigan or any other

state in U.S.

- The exemption exists only when the buildings and other property thereon are occupied by

the claimant solely for the purpose for which it is incorporated.

ATTACH COPIES OF THE FOLLOWING TO THIS FORM:

- Articles of Incorporation

- Organization's or church's By-Laws

- Copy of deed or land contract showing ownership

Page # 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4