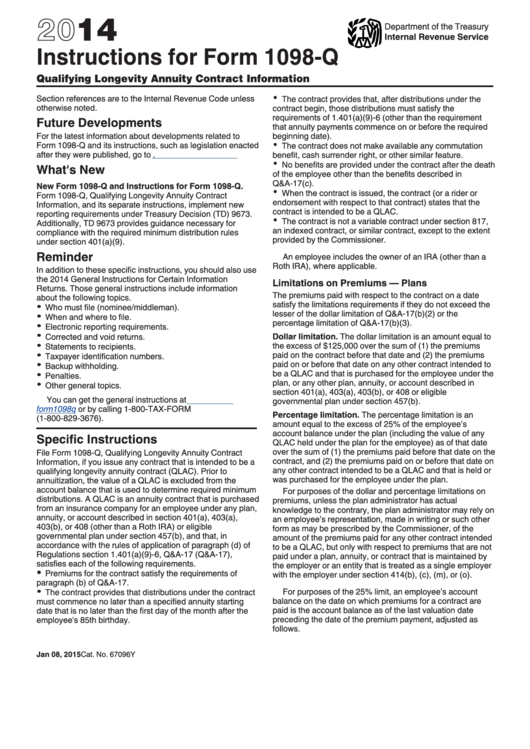

Instructions For Form 1098-Q - Qualifying Longevity Annuity Contract Information - 2014

ADVERTISEMENT

2014

Department of the Treasury

Internal Revenue Service

Instructions for Form 1098-Q

Qualifying Longevity Annuity Contract Information

Section references are to the Internal Revenue Code unless

The contract provides that, after distributions under the

otherwise noted.

contract begin, those distributions must satisfy the

requirements of 1.401(a)(9)-6 (other than the requirement

Future Developments

that annuity payments commence on or before the required

For the latest information about developments related to

beginning date).

Form 1098-Q and its instructions, such as legislation enacted

The contract does not make available any commutation

after they were published, go to

benefit, cash surrender right, or other similar feature.

No benefits are provided under the contract after the death

What's New

of the employee other than the benefits described in

Q&A-17(c).

New Form 1098-Q and Instructions for Form 1098-Q.

When the contract is issued, the contract (or a rider or

Form 1098-Q, Qualifying Longevity Annuity Contract

endorsement with respect to that contract) states that the

Information, and its separate instructions, implement new

contract is intended to be a QLAC.

reporting requirements under Treasury Decision (TD) 9673.

The contract is not a variable contract under section 817,

Additionally, TD 9673 provides guidance necessary for

an indexed contract, or similar contract, except to the extent

compliance with the required minimum distribution rules

provided by the Commissioner.

under section 401(a)(9).

Reminder

An employee includes the owner of an IRA (other than a

Roth IRA), where applicable.

In addition to these specific instructions, you should also use

the 2014 General Instructions for Certain Information

Limitations on Premiums — Plans

Returns. Those general instructions include information

The premiums paid with respect to the contract on a date

about the following topics.

satisfy the limitations requirements if they do not exceed the

Who must file (nominee/middleman).

lesser of the dollar limitation of Q&A-17(b)(2) or the

When and where to file.

percentage limitation of Q&A-17(b)(3).

Electronic reporting requirements.

Dollar limitation. The dollar limitation is an amount equal to

Corrected and void returns.

the excess of $125,000 over the sum of (1) the premiums

Statements to recipients.

paid on the contract before that date and (2) the premiums

Taxpayer identification numbers.

paid on or before that date on any other contract intended to

Backup withholding.

be a QLAC and that is purchased for the employee under the

Penalties.

plan, or any other plan, annuity, or account described in

Other general topics.

section 401(a), 403(a), 403(b), or 408 or eligible

You can get the general instructions at

governmental plan under section 457(b).

form1098q

or by calling 1-800-TAX-FORM

Percentage limitation. The percentage limitation is an

(1-800-829-3676).

amount equal to the excess of 25% of the employee’s

account balance under the plan (including the value of any

Specific Instructions

QLAC held under the plan for the employee) as of that date

over the sum of (1) the premiums paid before that date on the

File Form 1098-Q, Qualifying Longevity Annuity Contract

contract, and (2) the premiums paid on or before that date on

Information, if you issue any contract that is intended to be a

any other contract intended to be a QLAC and that is held or

qualifying longevity annuity contract (QLAC). Prior to

was purchased for the employee under the plan.

annuitization, the value of a QLAC is excluded from the

account balance that is used to determine required minimum

For purposes of the dollar and percentage limitations on

distributions. A QLAC is an annuity contract that is purchased

premiums, unless the plan administrator has actual

from an insurance company for an employee under any plan,

knowledge to the contrary, the plan administrator may rely on

annuity, or account described in section 401(a), 403(a),

an employee’s representation, made in writing or such other

403(b), or 408 (other than a Roth IRA) or eligible

form as may be prescribed by the Commissioner, of the

governmental plan under section 457(b), and that, in

amount of the premiums paid for any other contract intended

accordance with the rules of application of paragraph (d) of

to be a QLAC, but only with respect to premiums that are not

Regulations section 1.401(a)(9)-6, Q&A-17 (Q&A-17),

paid under a plan, annuity, or contract that is maintained by

satisfies each of the following requirements.

the employer or an entity that is treated as a single employer

Premiums for the contract satisfy the requirements of

with the employer under section 414(b), (c), (m), or (o).

paragraph (b) of Q&A-17.

For purposes of the 25% limit, an employee’s account

The contract provides that distributions under the contract

balance on the date on which premiums for a contract are

must commence no later than a specified annuity starting

paid is the account balance as of the last valuation date

date that is no later than the first day of the month after the

preceding the date of the premium payment, adjusted as

employee's 85th birthday.

follows.

Jan 08, 2015

Cat. No. 67096Y

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3