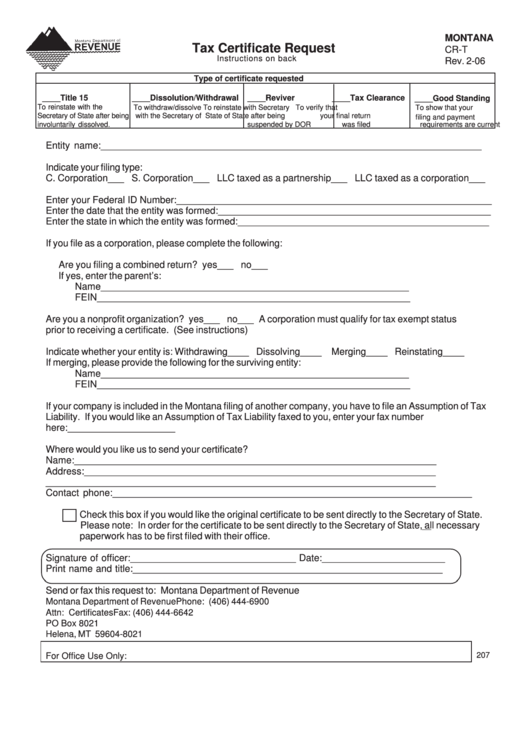

MONTANA

Tax Certificate Request

CR-T

Instructions on back

Rev. 2-06

Type of certificate requested

____Title 15

____Dissolution/Withdrawal

____Reviver

____Tax Clearance

____Good Standing

To reinstate with the

To withdraw/dissolve

To reinstate with Secretary To verify that

To show that your

Secretary of State after being

with the Secretary of State

of State after being

your final return

filing and payment

involuntarily dissolved.

suspended by DOR

was filed

requirements are current

Entity name:_______________________________________________________________________

Indicate your filing type:

C. Corporation___ S. Corporation___ LLC taxed as a partnership___ LLC taxed as a corporation___

Enter your Federal ID Number:___________________________________________________________

Enter the date that the entity was formed:___________________________________________________

Enter the state in which the entity was formed:_______________________________________________

If you file as a corporation, please complete the following:

Are you filing a combined return? yes___ no___

If yes, enter the parent’s:

Name_________________________________________________________

FEIN__________________________________________________________

Are you a nonprofit organization? yes___ no___ A corporation must qualify for tax exempt status

prior to receiving a certificate. (See instructions)

Indicate whether your entity is: Withdrawing____ Dissolving____ Merging____ Reinstating____

If merging, please provide the following for the surviving entity:

Name_________________________________________________________

FEIN__________________________________________________________

If your company is included in the Montana filing of another company, you have to file an Assumption of Tax

Liability. If you would like an Assumption of Tax Liability faxed to you, enter your fax number

here:____________________

Where would you like us to send your certificate?

Name:___________________________________________________________________

Address:_________________________________________________________________

________________________________________________________________________

Contact phone:___________________________________________________________________

Check this box if you would like the original certificate to be sent directly to the Secretary of State.

Please note: In order for the certificate to be sent directly to the Secretary of State, all necessary

paperwork has to be first filed with their office.

Signature of officer:_______________________________ Date:_______________________

Print name and title:__________________________________________________________

Send or fax this request to: Montana Department of Revenue

Montana Department of Revenue

Phone: (406) 444-6900

Attn: Certificates

Fax:

(406) 444-6642

PO Box 8021

Helena, MT 59604-8021

For Office Use Only:

207

1

1