Non-HOME-assisted affordable housing is investment

post-improvement property value. For those taxes, fees,

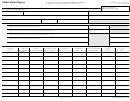

bond financing as an eligible source of match will be

in housing not assisted by HOME funds that would

or charges given for future years, the value is the present

available upon publication of the implementing regu-

qualify as “affordable housing” under the HOME Pro-

discounted cash value. [§92.220(a)(2)]

lation early in FY 1994.

gram definitions. “NON” funds must be contributed to

5. Appraised Land/Real Property: The appraised value,

9. Total Match: Total of items 3 through 8. This is the

a specific project; it is not sufficient to make a contri-

before the HOME assistance is provided and minus

total match contribution for each project identified in

bution to an entity engaged in developing affordable

any debt burden, lien, or other encumbrance, of land or

item 1.

housing. [§92.219(b)]

other real property, not acquired with Federal re-

Ineligible forms of match include:

2. Date of Contribution: Enter the date of contribution.

sources. The appraisal must be made by an indepen-

Multiple entries may be made on a single line as long as

dent, certified appraiser. [§92.220(a)(3)]

1. Contributions made with or derived from Federal re-

the contributions were made during the current fiscal

sources e.g. CDBG funds [§92.220(b)(1)]

6. Required Infrastructure: The cost of investment, not

year. In such cases, if the contributions were made at

made with Federal resources, in on-site and off-site

2. Interest rate subsidy attributable to the Federal tax-

different dates during the year, enter the date of the last

infrastructure directly required for HOME-assisted

exemption on financing or the value attributable to

contribution.

affordable housing. The infrastructure must have been

Federal tax credits [§92.220(b)(2)]

3. Cash: Cash contributions from non-Federal resources.

completed no earlier than 12 months before HOME

3. Contributions from builders, contractors or investors,

This means the funds are contributed permanently to the

funds were committed. [§92.220(a)(4)]

including owner equity, involved with HOME-assisted

HOME Program regardless of the form of investment the

7. Site preparation, Construction materials, Donated

projects. [§92.220(b)(3)]

jurisdiction provides to a project. Therefore all repay-

labor: The reasonable value of any site-preparation

ment, interest, or other return on investment of the con-

4. Sweat equity [§92.220(b)(4)]

and construction materials, not acquired with Federal

tribution must be deposited in the PJ’s HOME account to

resources, and any donated or voluntary labor (see

5. Contributions from applicants/recipients of HOME

be used for HOME projects. The PJ, non-Federal public

§92.354(b)) in connection with the site-preparation

assistance [§92.220(b)(5)]

entities (State/local governments), private entities, and

for, or construction or rehabilitation of, affordable

individuals can make contributions. The grant equiva-

6. Fees/charges that are associated with the HOME Pro-

housing. The value of site-preparation and construc-

lent of a below-market interest rate loan to the project is

gram only, rather than normally and customarily

tion materials is determined in accordance with the

eligible when the loan is not repayable to the PJ’s HOME

charged on all transactions or projects [§92.220(a)(2)]

PJ’s cost estimate procedures. The value of donated or

account. [§92.220(a)(1)] In addition, a cash contribution

voluntary labor is determined by a single rate (“labor

7. Administrative costs

can count as match if it is used for eligible costs defined

rate”) to be published annually in the Notice Of Fund-

under §92.206 (except administrative costs and CHDO

ing Availability (NOFA) for the HOME Program.

operating expenses) or under §92.209, or for the follow-

[§92.220(6)]

ing non-eligible costs: the value of non-Federal funds

used to remove and relocate ECHO units to accommo-

8. Bond Financing: Multifamily and single-family

date eligible tenants, a project reserve account for re-

project bond financing must be validly issued by a

placements, a project reserve account for unanticipated

State or local government (or an agency, instrumental-

increases in operating costs, operating subsidies, or costs

ity, or political subdivision thereof). 50% of a loan

relating to the portion of a mixed-income or mixed-use

from bond proceeds made to a multifamily affordable

project not related to the affordable housing units.

housing project owner can count as match. 25% of a

[§92.219(c)]

loan from bond proceeds made to a single-family

affordable housing project owner can count as match.

4. Foregone Taxes, Fees, Charges: Taxes, fees, and charges

Loans from all bond proceeds, including excess bond

that are normally and customarily charged but have been

match from prior years, may not exceed 25% of a PJ’s

waived, foregone, or deferred in a manner that achieves

total annual match contribution. [§92.220(a)(5)] The

affordability of the HOME-assisted housing. This in-

amount in excess of the 25% cap for bonds may carry

cludes State tax credits for low-income housing develop-

over, and the excess will count as part of the statutory

ment. The amount of real estate taxes may be based on the

limit of up to 25% per year. Requirements regarding

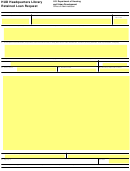

page 4 of 4 pages

form HUD-40107-A (12/94)

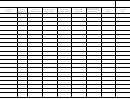

1

1 2

2 3

3 4

4