Form 941cf-Me - Nonresident Member Affidavit And Agreement To Participate In A Composite Filing Of Maine Income Tax

ADVERTISEMENT

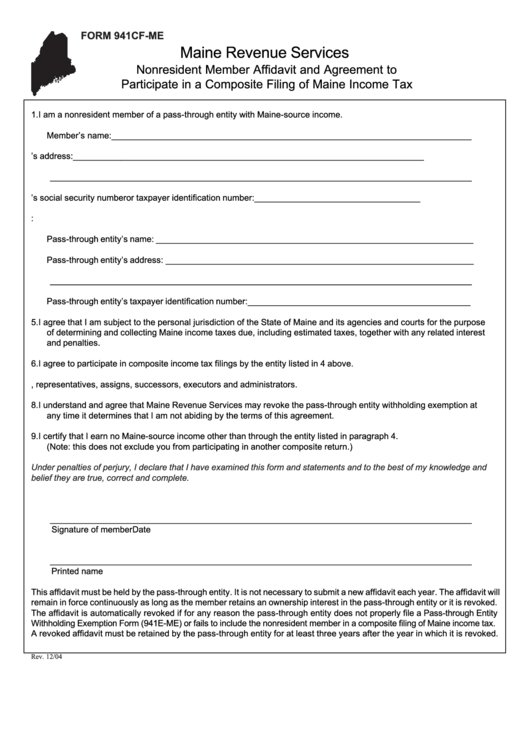

FORM 941CF-ME

Maine Revenue Services

Nonresident Member Affidavit and Agreement to

Participate in a Composite Filing of Maine Income Tax

1. I am a nonresident member of a pass-through entity with Maine-source income.

Member’s name: ____________________________________________________________________________

2. Member’s address: __________________________________________________________________________

_________________________________________________________________________________________

3. Member’s social security number or taxpayer identification number: ___________________________________

4. The pass-through entity for which this agreement applies:

Pass-through entity’s name: ___________________________________________________________________

Pass-through entity’s address: _________________________________________________________________

_________________________________________________________________________________________

Pass-through entity’s taxpayer identification number: _______________________________________________

5. I agree that I am subject to the personal jurisdiction of the State of Maine and its agencies and courts for the purpose

of determining and collecting Maine income taxes due, including estimated taxes, together with any related interest

and penalties.

6. I agree to participate in composite income tax filings by the entity listed in 4 above.

7. This agreement is binding upon my heirs, representatives, assigns, successors, executors and administrators.

8. I understand and agree that Maine Revenue Services may revoke the pass-through entity withholding exemption at

any time it determines that I am not abiding by the terms of this agreement.

9. I certify that I earn no Maine-source income other than through the entity listed in paragraph 4.

(Note: this does not exclude you from participating in another composite return.)

Under penalties of perjury, I declare that I have examined this form and statements and to the best of my knowledge and

belief they are true, correct and complete.

_________________________________________________________________________________________

Signature of member

Date

_________________________________________________________________________________________

Printed name

This affidavit must be held by the pass-through entity. It is not necessary to submit a new affidavit each year. The affidavit will

remain in force continuously as long as the member retains an ownership interest in the pass-through entity or it is revoked.

The affidavit is automatically revoked if for any reason the pass-through entity does not properly file a Pass-through Entity

Withholding Exemption Form (941E-ME) or fails to include the nonresident member in a composite filing of Maine income tax.

A revoked affidavit must be retained by the pass-through entity for at least three years after the year in which it is revoked.

Rev. 12/04

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1