Instructions For Preparing And Filing Form W-3q Reconciliation - Springfield, Ohio

ADVERTISEMENT

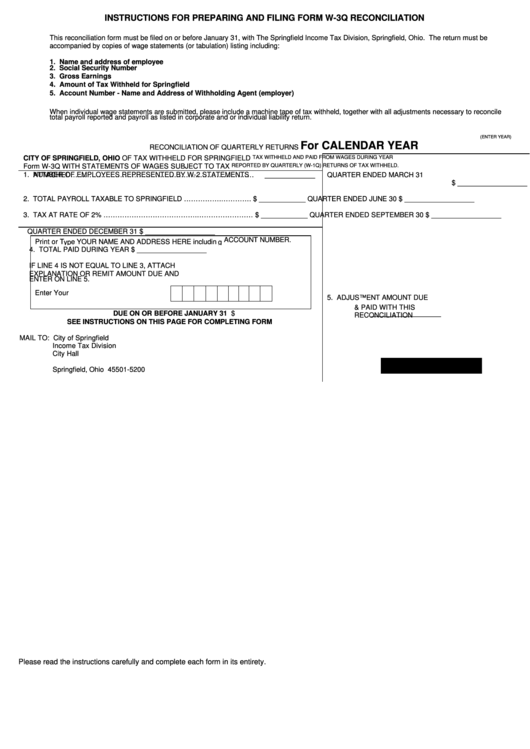

INSTRUCTIONS FOR PREPARING AND FILING FORM W-3Q RECONCILIATION

This reconciliation form must be filed on or before January 31, with The Springfield Income Tax Division, Springfield, Ohio. The return must be

accompanied by copies of wage statements (or tabulation) listing including:

1.

Name and address of employee

2.

Social Security Number

3.

Gross Earnings

4.

Amount of Tax Withheld for Springfield

5.

Account Number - Name and Address of Withholding Agent (employer)

When individual wage statements are submitted, please include a machine tape of tax withheld, together with all adjustments necessary to reconcile

total payroll reported and payroll as listed in corporate and or individual liability return.

(ENTER YEAR)

For CALENDAR YEAR

RECONCILIATION OF QUARTERLY RETURNS

OF TAX WITHHELD FOR SPRINGFIELD

TAX WITHHELD AND PAID FROM WAGES DURING YEAR

CITY OF SPRINGFIELD, OHIO

Form W-3Q

WITH STATEMENTS OF WAGES SUBJECT TO TAX

REPORTED BY QUARTERLY (W-1Q) RETURNS OF TAX WITHHELD.

1. NUMBER OF EMPLOYEES REPRESENTED BY W-2 STATEMENTS

ATTACHED……………………………………………………………………

_____________

QUARTER ENDED MARCH 31

$ __________________

2. TOTAL PAYROLL TAXABLE TO SPRINGFIELD …………….………….

$ ____________

QUARTER ENDED JUNE 30

$ __________________

3. TAX AT RATE OF 2% ………………………………….……………………

$ ____________

QUARTER ENDED SEPTEMBER 30

$ __________________

QUARTER ENDED DECEMBER 31

$ __________________

Print or Type YOUR NAME AND ADDRESS HERE including ACCOUNT NUMBER.

4. TOTAL PAID DURING YEAR

$ __________________

IF LINE 4 IS NOT EQUAL TO LINE 3, ATTACH

EXPLANATION OR REMIT AMOUNT DUE AND

ENTER ON LINE 5.

Enter Your F.E.I.N. or S.S.N. Here

5. ADJUSTMENT AMOUNT DUE

& PAID WITH THIS

$ __________________

DUE ON OR BEFORE JANUARY 31

RECONCILIATION

SEE INSTRUCTIONS ON THIS PAGE FOR COMPLETING FORM

MAIL TO: City of Springfield

Income Tax Division

City Hall

P.O. Box 5200

RETURN THIS COPY

Springfield, Ohio 45501-5200

Please read the instructions carefully and complete each form in its entirety.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2