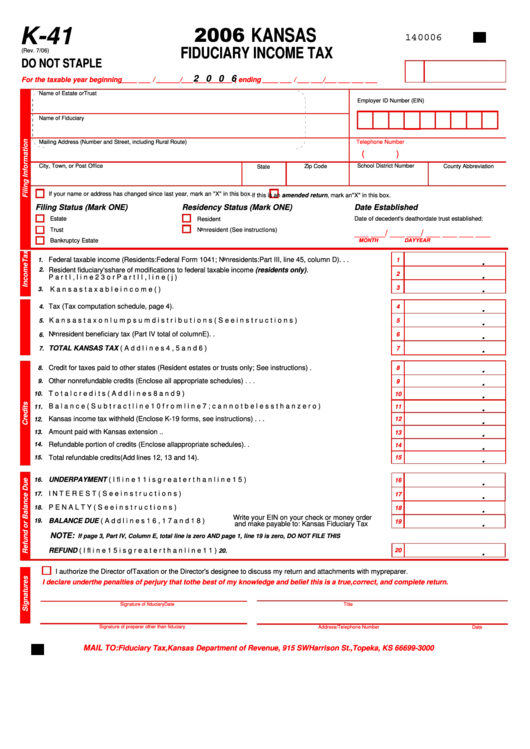

Form K-41 - Kansas Fiduciary Income Tax - 2006

ADVERTISEMENT

2006 KANSAS

K-41

140006

FIDUCIARY INCOME TAX

(Rev. 7/06)

DO NOT STAPLE

2 0 0 6

For the taxable year beginning ____ ___ / ___ ___/___ ___ ___ ___ ; ending ____ ___ / ___ ___/___ ___ ___ ___

Name of Estate or Trust

Employer ID Number (EIN)

Name of Fiduciary

Mailing Address (Number and Street, including Rural Route)

Telephone Number

(

)

School District Number

City, Town, or Post Office

Zip Code

County Abbreviation

State

If your name or address has changed since last year, mark an "X" in this box.

If this is an amended return, mark an "X" in this box.

Filing Status (Mark ONE)

Residency Status (Mark ONE)

Date Established

Estate

Date of decedent's death or date trust established:

Resident

Nonresident (See instructions)

Trust

___ ___ / ___ ___ / ___ ___ ___ ___

Bankruptcy Estate

MONTH

DAY

YEAR

Federal taxable income (Residents: Federal Form 1041; Nonresidents: Part III, line 45, column D). . . . . . . . . . .

.

1.

1

Resident fiduciary's share of modifications to federal taxable income (residents only).

2.

2

.

Part I, line 23 or Part II, line (j). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

3

3.

Kansas taxable income (Line 2 plus or minus line 1. See instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Tax (Tax computation schedule, page 4). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

4

.

Kansas tax on lump sum distributions (See instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

5.

5

Nonresident beneficiary tax (Part IV total of column E). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

6

6.

TOTAL KANSAS TAX (Add lines 4, 5 and 6). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

7.

7

Credit for taxes paid to other states (Resident estates or trusts only; See instructions) . . . . . . . . . . . . . . . . . . . . .

.

8.

8

Other nonrefundable credits (Enclose all appropriate schedules) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

9.

9

Total credits (Add lines 8 and 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

10.

10

Balance (Subtract line 10 from line 7; cannot be less than zero) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

11.

11

Kansas income tax withheld (Enclose K-19 forms, see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

12.

12

Amount paid with Kansas extension . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13.

.

13

Refundable portion of credits (Enclose all appropriate schedules). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14.

.

14

Total refundable credits (Add lines 12, 13 and 14). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15.

15

.

UNDERPAYMENT (If line 11 is greater than line 15) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16.

.

16

INTEREST (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17.

.

17

PENALTY (See instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18.

.

18

Write your EIN on your check or money order

BALANCE DUE (Add lines 16, 17 and 18). . . . . . . . . . . .

19.

.

19

and make payable to: Kansas Fiduciary Tax

NOTE:

If page 3, Part IV, Column E, total line is zero AND page 1, line 19 is zero, DO NOT FILE THIS RETURN. Both entries must be zero.

REFUND (If line 15 is greater than line 11). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

20.

20

I authorize the Director of Taxation or the Director's designee to discuss my return and attachments with my preparer.

I declare under the penalties of perjury that to the best of my knowledge and belief this is a true, correct, and complete return.

Signature of fiduciary

Title

Date

Signature of preparer other than fiduciary

Address/Telephone Number

Date

MAIL TO:

Fiduciary Tax, Kansas Department of Revenue, 915 SW Harrison St., Topeka, KS 66699-3000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5