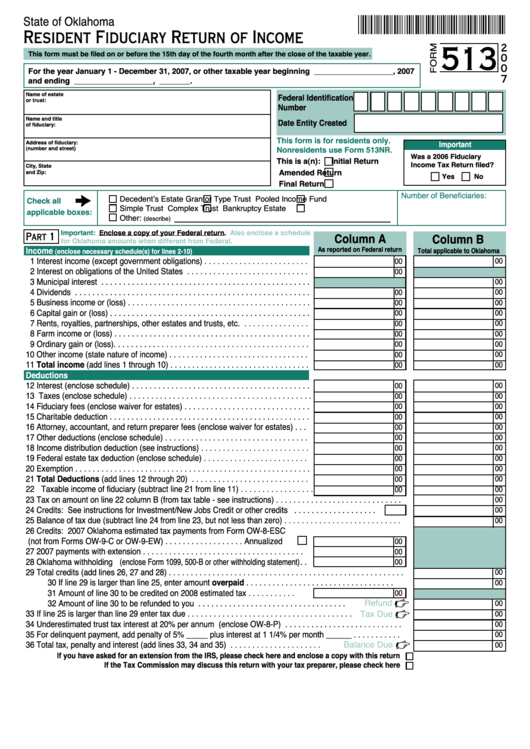

State of Oklahoma

Resident Fiduciary Return of Income

513

2

This form must be filed on or before the 15th day of the fourth month after the close of the taxable year.

0

0

For the year January 1 - December 31, 2007, or other taxable year beginning __________________, 2007

7

and ending __________________, _______.

Name of estate

Federal Identification

or trust:

Number

Name and title

Date Entity Created

of fiduciary:

This form is for residents only.

Address of fiduciary:

Important

Nonresidents use Form 513NR.

(number and street)

Was a 2006 Fiduciary

This is a(n):

Initial Return

Income Tax Return filed?

City, State

Amended Return

and Zip:

Yes

No

Final Return

Number of Beneficiaries:

Decedent’s Estate

Grantor Type Trust

Pooled Income Fund

Check all

Simple Trust

Complex Trust

Bankruptcy Estate

applicable boxes:

Other:

(describe)

Important:

Enclose a copy of your Federal return.

Also enclose a schedule

Part 1

Column A

Column B

for Oklahoma amounts when different from Federal.

Income

As reported on Federal return

Total applicable to Oklahoma

(enclose necessary schedule(s) for lines 2-10)

1 Interest income (except government obligations) . . . . . . . . . . . . . . . . . . . . . . . .

00

00

2 Interest on obligations of the United States . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

3 Municipal interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

4 Dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

5 Business income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

6 Capital gain or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

7 Rents, royalties, partnerships, other estates and trusts, etc. . . . . . . . . . . . . . . .

00

00

8 Farm income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

9 Ordinary gain or (loss). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

10 Other income (state nature of income) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

11 Total income (add lines 1 through 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

Deductions

12 Interest (enclose schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

13 Taxes (enclose schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

14 Fiduciary fees (enclose waiver for estates) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

15 Charitable deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

16 Attorney, accountant, and return preparer fees (enclose waiver for estates) . . .

00

00

17 Other deductions (enclose schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

18 Income distribution deduction (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

19 Federal estate tax deduction (enclose schedule) . . . . . . . . . . . . . . . . . . . . . . . .

00

00

20 Exemption . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

21 Total Deductions (add lines 12 through 20) . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

22 Taxable income of fiduciary (subtract line 21 from line 11) . . . . . . . . . . . . . . . . .

00

00

23 Tax on amount on line 22 column B (from tax table - see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

24 Credits: See instructions for Investment/New Jobs Credit or other credits . . . . . . . . . . . . . . . . . . .

00

25 Balance of tax due (subtract line 24 from line 23, but not less than zero) . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

26 Credits: 2007 Oklahoma estimated tax payments from Form OW-8-ESC

(not from Forms OW-9-C or OW-9-EW) . . . . . . . . . . . . . . . . . . Annualized

00

27 2007 payments with extension . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

28 Oklahoma withholding (enclose Form 1099, 500-B or other withholding statement). .

00

29 Total credits (add lines 26, 27 and 28) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

30

If line 29 is larger than line 25, enter amount overpaid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

31

Amount of line 30 to be credited on 2008 estimated tax . . . . . . . . . . .

00

Refund

32

Amount of line 30 to be refunded to you . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

33 If line 25 is larger than line 29 enter tax due . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Tax Due

00

34 Underestimated trust tax interest at 20% per annum (enclose OW-8-P) . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

35 For delinquent payment, add penalty of 5% _____ plus interest at 1 1/4% per month ______ . . . . . . . . . . .

00

Balance Due

36 Total tax, penalty and interest (add lines 33, 34 and 35) . . . . . . . . . . . . . . . . . . . . .

00

If you have asked for an extension from the IRS, please check here and enclose a copy with this return

If the Tax Commission may discuss this return with your tax preparer, please check here

1

1 2

2