Print and Reset Form

Reset Form

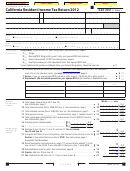

Your name _____________________________ Your SSN or ITIN: _________________________

21

Total tax withheld (federal Form W-2, box 17 or CA Sch W-2, box 17

Overpaid

0 0

Tax/ Tax Due

. . . . .

and/or Form 1099-R, box 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

,

“Attach a copy of your

. . . . .

0 0

22

Overpaid tax. If line 21 is more than line 20, subtract line 20 from line 21 . . . .

22

,

Form(s) W-2 or

complete CA Sch W-2”

23

Tax due. If line 21 is less than line 20, subtract line 21 from line 20.

0 0

See instructions, page 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

. . . . .

,

Use Tax

¼ ¼ ¼ ¼ ¼

0 0

. . . . .

24

Use tax. This is not a total line. See instructions, page 9 . . . . . . . . . . . . . . .

24

,

Contributions

Voluntary Contributions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Code

Amount

¼ ¼ ¼ ¼ ¼

00

California Seniors Special Fund. See instructions, page 10 . . . . . . . .

52

________________

¼ ¼ ¼ ¼ ¼

00

Alzheimer’s Disease/Related Disorders Fund . . . . . . . . . . . . . . . . . . .

53

________________

¼ ¼ ¼ ¼ ¼

00

California Fund for Senior Citizens . . . . . . . . . . . . . . . . . . . . . . . . . . .

54

________________

¼ ¼ ¼ ¼ ¼

00

Rare and Endangered Species Preservation Program . . . . . . . . . . . .

55

________________

¼ ¼ ¼ ¼ ¼

00

State Children’s Trust Fund for the Prevention of Child Abuse . . . . . .

56

________________

¼ ¼ ¼ ¼ ¼

00

California Breast Cancer Research Fund . . . . . . . . . . . . . . . . . . . . . .

57

________________

¼ ¼ ¼ ¼ ¼

00

California Firefighters’ Memorial Fund . . . . . . . . . . . . . . . . . . . . . . . . .

58

________________

¼ ¼ ¼ ¼ ¼

00

Emergency Food Assistance Program Fund . . . . . . . . . . . . . . . . . . . .

59

________________

¼ ¼ ¼ ¼ ¼

00

California Peace Officer Memorial Foundation Fund . . . . . . . . . . . . .

60

________________

¼ ¼ ¼ ¼ ¼

00

California Military Family Relief Fund . . . . . . . . . . . . . . . . . . . . . . . . .

63

________________

¼ ¼ ¼ ¼ ¼

00

California Prostate Cancer Research Fund . . . . . . . . . . . . . . . . . . . .

64

________________

¼ ¼ ¼ ¼ ¼

Veterans’ Quality of Life Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

65

________________

00

¼ ¼ ¼ ¼ ¼

00

California Sexual Violence Victim Services Fund . . . . . . . . . . . . . . . .

66

________________

¼ ¼ ¼ ¼ ¼

00

California Colorectal Cancer Prevention Fund . . . . . . . . . . . . . . . . . .

67

________________

¼ ¼ ¼ ¼ ¼

0 0

. . . . .

25 Add line 52 through line 67. These are your total contributions . . . . . . . . . . . . .

25

,

Refund or

26 REFUND or NO AMOUNT DUE. Subtract line 24 and line 25 from line 22. If line 22

Amount You

is less than line 24 and line 25, enter the difference on line 27.

Owe

See instructions, page 11. Mail to:

0 0

FRANCHISE TAX BOARD, PO BOX 942840, SACRAMENTO CA 94240-0002. . . . .

26

. . . . .

,

27 AMOUNT YOU OWE. Add line 23, line 24, and line 25.

See instructions, page 11. Mail to:

0 0

FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA 94267-0001 . . . .

27

. . . . .

,

Pay online – Go to our Website at

Get Your Refund Faster with Direct Deposit

Do not attach a voided check or a deposit slip. See instructions, page 11.

¼ ¼ ¼ ¼ ¼

Fill in the boxes to have your refund directly deposited. Routing number . . .

Direct

Deposit

¼ ¼ ¼ ¼ ¼

¼ ¼ ¼ ¼ ¼

Account Type:

Checking

Savings

(Refund Only)

¼ ¼ ¼ ¼ ¼

Account number . . . . . . . . . . . . .

Under penalties of perjury, I declare that, to the best of my knowledge and belief, the information on this return is true, correct, and

complete.

3

Sign Here

It is unlawful to

Your signature

Spouse’s signature (if filing jointly, both must sign)

Daytime phone number (optional)

forge a spouse’s

)

(

signature.

X

X

Date

Joint return?

Paid Preparer’s SSN/PTIN

Paid preparer’s signature (declaration of preparer is based on all information of which preparer has any knowledge)

See instructions,

¼

page 12.

Firm’s name (or yours if self-employed)

Firm’s address

FEIN

¼

Side 2 Form 540 2EZ

2005

2EZ05203

C1

1

1 2

2