Publication 109 - Form Soa-1 - Statement Of Account For Sales Tax Instructions

ADVERTISEMENT

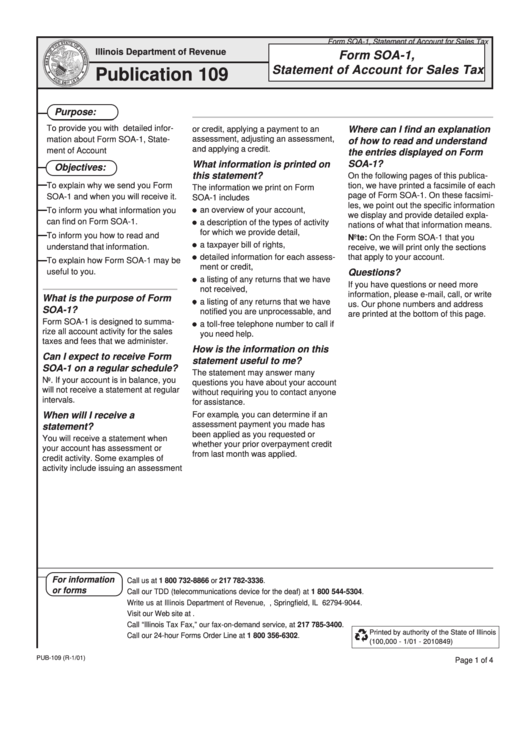

Form SOA-1, Statement of Account for Sales Tax

Illinois Department of Revenue

Form SOA-1,

Statement of Account for Sales Tax

Publication 109

Purpose:

To provide you with detailed infor-

or credit, applying a payment to an

Where can I find an explanation

assessment, adjusting an assessment,

mation about Form SOA-1, State-

of how to read and understand

and applying a credit.

ment of Account

the entries displayed on Form

SOA-1?

What information is printed on

Objectives:

this statement?

On the following pages of this publica-

To explain why we send you Form

tion, we have printed a facsimile of each

The information we print on Form

page of Form SOA-1. On these facsimi-

SOA-1 and when you will receive it.

SOA-1 includes

les, we point out the specific information

an overview of your account,

To inform you what information you

we display and provide detailed expla-

can find on Form SOA-1.

a description of the types of activity

nations of what that information means.

for which we provide detail,

To inform you how to read and

Note: On the Form SOA-1 that you

a taxpayer bill of rights,

understand that information.

receive, we will print only the sections

detailed information for each assess-

that apply to your account.

To explain how Form SOA-1 may be

ment or credit,

useful to you.

Questions?

a listing of any returns that we have

If you have questions or need more

not received,

information, please e-mail, call, or write

What is the purpose of Form

a listing of any returns that we have

us. Our phone numbers and address

SOA-1?

notified you are unprocessable, and

are printed at the bottom of this page.

Form SOA-1 is designed to summa-

a toll-free telephone number to call if

rize all account activity for the sales

you need help.

taxes and fees that we administer.

How is the information on this

Can I expect to receive Form

statement useful to me?

SOA-1 on a regular schedule?

The statement may answer many

No. If your account is in balance, you

questions you have about your account

will not receive a statement at regular

without requiring you to contact anyone

intervals.

for assistance.

For example , you can determine if an

When will I receive a

assessment payment you made has

statement?

been applied as you requested or

You will receive a statement when

whether your prior overpayment credit

your account has assessment or

from last month was applied.

credit activity. Some examples of

activity include issuing an assessment

For information

Call us at 1 800 732-8866 or 217 782-3336.

or forms

Call our TDD (telecommunications device for the deaf) at 1 800 544-5304.

Write us at Illinois Department of Revenue, P.O. Box 19044, Springfield, IL 62794-9044.

Visit our Web site at

Call “Illinois Tax Fax,” our fax-on-demand service, at 217 785-3400.

Printed by authority of the State of Illinois

Call our 24-hour Forms Order Line at 1 800 356-6302.

(100,000 - 1/01 - 2010849)

PUB-109 (R-1/01)

Page 1 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4