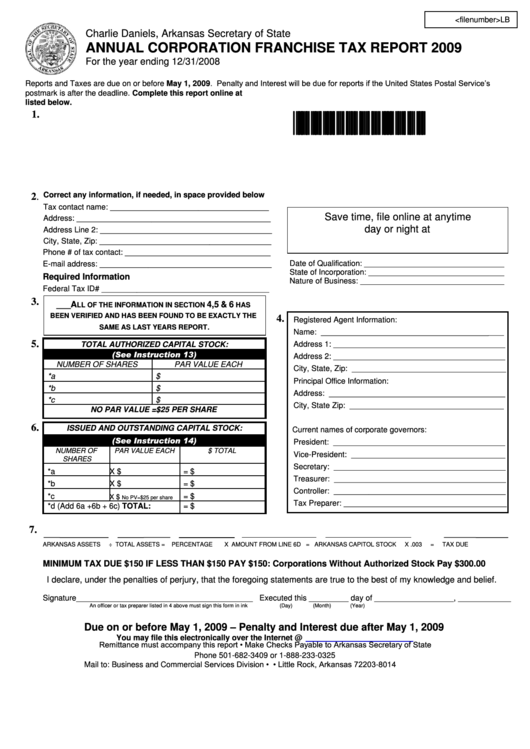

Annual Corporation Franchise Tax Report - Arkansas Secretary Of State - 2009

ADVERTISEMENT

<filenumber>LB

Charlie Daniels, Arkansas Secretary of State

ANNUAL CORPORATION FRANCHISE TAX REPORT 2009

For the year ending 12/31/2008

Reports and Taxes are due on or before May 1, 2009. Penalty and Interest will be due for reports if the United States Postal Service’s

postmark is after the deadline. Complete this report online at or sign in ink and mail to the address

listed below.

1.

*123456789*

Correct any information, if needed, in space provided below

2.

Tax contact name: ____________________________________

Save time, file online at anytime

Address: ____________________________________________

day or night at

Address Line 2: _______________________________________

.

City, State, Zip: _______________________________________

Phone # of tax contact: _________________________________

Date of Qualification: ________________________________

E-mail address: _______________________________________

State of Incorporation: _______________________________

Required Information

Nature of Business: _________________________________

Federal Tax ID# ______________________________________

3.

___A

4, 5 & 6

LL OF THE INFORMATION IN SECTION

HAS

BEEN VERIFIED AND HAS BEEN FOUND TO BE EXACTLY THE

4.

Registered Agent Information:

.

SAME AS LAST YEARS REPORT

Name: ______________________________________

____

5.

TOTAL AUTHORIZED CAPITAL STOCK:

Address 1: _______________________________________

(See Instruction 13)

Address 2: _______________________________________

NUMBER OF SHARES

PAR VALUE EACH

City, State, Zip: ___________________________________

*a

$

Principal Office Information:

*b

$

Address: ________________________________________

*c

$

City, State Zip: ___________________________________

NO PAR VALUE =$25 PER SHARE

6.

ISSUED AND OUTSTANDING CAPITAL STOCK:

Current names of corporate governors:

(See Instruction 14)

President: _______________________________________

NUMBER OF

PAR VALUE EACH

$ TOTAL

Vice-President: ___________________________________

SHARES

Secretary: _______________________________________

*a

X $

= $

Treasurer: _______________________________________

*b

X $

= $

Controller: _______________________________________

*c

= $

X $

No PV=$25 per share

Tax Preparer: _____________________________________

= $

*d

(Add 6a +6b + 6c) TOTAL:

7.

ARKANSAS ASSETS

÷

TOTAL ASSETS

=

PERCENTAGE

X AMOUNT FROM LINE 6D = ARKANSAS CAPITOL STOCK

X .003

=

TAX DUE

MINIMUM TAX DUE $150 IF LESS THAN $150 PAY $150: Corporations Without Authorized Stock Pay $300.00

I declare, under the penalties of perjury, that the foregoing statements are true to the best of my knowledge and belief.

Signature________________________________________ Executed this _________ day of __________________, ____________

An officer or tax preparer listed in 4 above must sign this form in ink

(Day)

(Month)

(Year)

Due on or before May 1, 2009 – Penalty and Interest due after May 1, 2009

You may file this electronically over the Internet @

Remittance must accompany this report • Make Checks Payable to Arkansas Secretary of State

Phone 501-682-3409 or 1-888-233-0325

Mail to: Business and Commercial Services Division • P.O. Box 8014 • Little Rock, Arkansas 72203-8014

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1