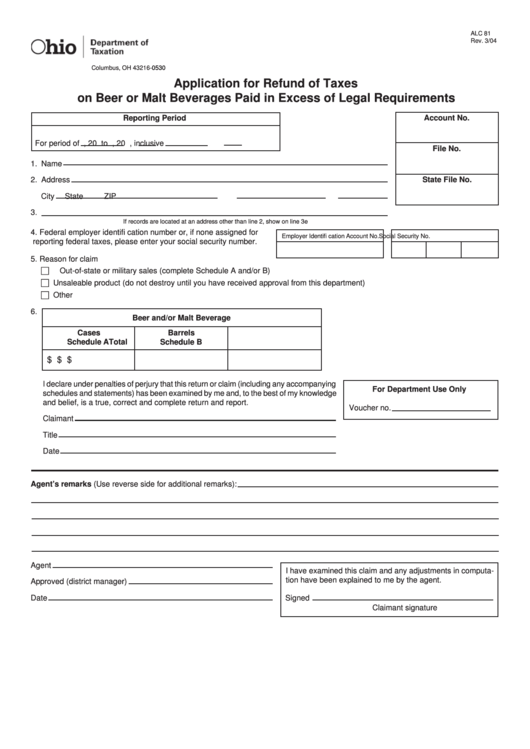

Application Form For Refund Of Taxes On Beer Or Malt Beverages Paid In Excess Of Legal Requirements

ADVERTISEMENT

ALC 81

Rev. 3/04

P.O. Box 530

Columbus, OH

43216-0530

Application for Refund of Taxes

on Beer or Malt Beverages Paid in Excess of Legal Requirements

Reporting Period

Account No.

For period of

, 20

to

, 20

, inclusive

File No.

1. Name

State File No.

2. Address

City

State

ZIP

3.

If records are located at an address other than line 2, show on line 3e

4. Federal employer identifi cation number or, if none assigned for

Employer Identifi cation Account No.

Social Security No.

reporting federal taxes, please enter your social security number.

5. Reason for claim

Out-of-state or military sales (complete Schedule A and/or B)

Unsaleable product (do not destroy until you have received approval from this department)

Other

6.

Beer and/or Malt Beverage

Barrels

Cases

Schedule A

Schedule B

Total

$

$

$

I declare under penalties of perjury that this return or claim (including any accompanying

For Department Use Only

schedules and statements) has been examined by me and, to the best of my knowledge

and belief, is a true, correct and complete return and report.

Voucher no.

Claimant

Title

Date

Agent’s remarks (Use reverse side for additional remarks):

Agent

I have examined this claim and any adjustments in computa-

tion have been explained to me by the agent.

Approved (district manager)

Date

Signed

Claimant signature

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1