Form Ct-12-717b - Change Of Resident Status - Special Accruals Other Acceptable Security Form

ADVERTISEMENT

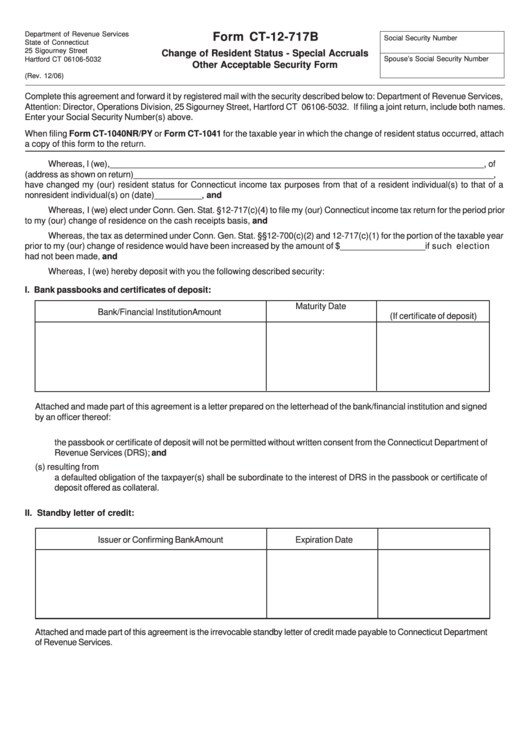

Department of Revenue Services

Form CT-12-717B

Social Security Number

State of Connecticut

25 Sigourney Street

Change of Resident Status - Special Accruals

Spouse’s Social Security Number

Hartford CT 06106-5032

Other Acceptable Security Form

(Rev. 12/06)

Complete this agreement and forward it by registered mail with the security described below to: Department of Revenue Services,

Attention: Director, Operations Division, 25 Sigourney Street, Hartford CT 06106-5032. If filing a joint return, include both names.

Enter your Social Security Number(s) above.

When filing Form CT-1040NR/PY or Form CT-1041 for the taxable year in which the change of resident status occurred, attach

a copy of this form to the return.

Whereas, I (we), _______________________________________________________________________________ , of

(address as shown on return) ____________________________________________________________________________,

have changed my (our) resident status for Connecticut income tax purposes from that of a resident individual(s) to that of a

nonresident individual(s) on (date) __________ , and

Whereas, I (we) elect under Conn. Gen. Stat. §12-717(c)(4) to file my (our) Connecticut income tax return for the period prior

to my (our) change of residence on the cash receipts basis, and

Whereas, the tax as determined under Conn. Gen. Stat. §§12-700(c)(2) and 12-717(c)(1) for the portion of the taxable year

prior to my (our) change of residence would have been increased by the amount of $ __________________ if such election

had not been made, and

Whereas, I (we) hereby deposit with you the following described security:

I. Bank passbooks and certificates of deposit:

Maturity Date

Bank/Financial Institution

Amount

(If certificate of deposit)

Attached and made part of this agreement is a letter prepared on the letterhead of the bank/financial institution and signed

by an officer thereof:

1.

Identifying the passbooks or certificates of deposit by account number and confirming that withdrawal of principal from

the passbook or certificate of deposit will not be permitted without written consent from the Connecticut Department of

Revenue Services (DRS); and

2.

Stating that any right of setoff which the bank/financial institution may possess against the taxpayer(s) resulting from

a defaulted obligation of the taxpayer(s) shall be subordinate to the interest of DRS in the passbook or certificate of

deposit offered as collateral.

II. Standby letter of credit:

Issuer or Confirming Bank

Amount

Expiration Date

Attached and made part of this agreement is the irrevocable standby letter of credit made payable to Connecticut Department

of Revenue Services.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2