Blanket Certificate Of Exemption Covering Purchases For Resale Or For Further Processing Form - Ascension Parish Sales And Use Tax Authority - Louisiana

ADVERTISEMENT

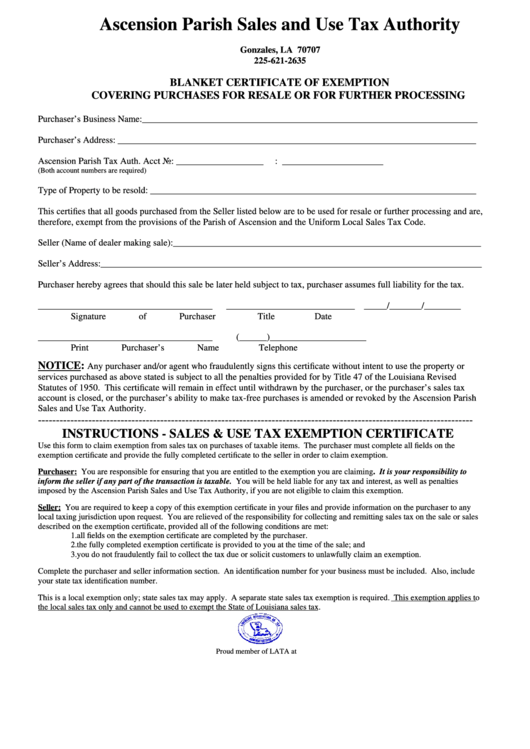

Ascension Parish Sales and Use Tax Authority

P.O. Box 1718

Gonzales, LA 70707

225-621-2635

BLANKET CERTIFICATE OF EXEMPTION

COVERING PURCHASES FOR RESALE OR FOR FURTHER PROCESSING

Purchaser’s Business Name:_________________________________________________________________________

Purchaser’s Address: ______________________________________________________________________________

Ascension Parish Tax Auth. Acct No: ___________________ La.Dept of Rev. Acct No.: ______________________

(Both account numbers are required)

Type of Property to be resold: _______________________________________________________________________

This certifies that all goods purchased from the Seller listed below are to be used for resale or further processing and are,

therefore, exempt from the provisions of the Parish of Ascension and the Uniform Local Sales Tax Code.

Seller (Name of dealer making sale):___________________________________________________________________

Seller’s Address:___________________________________________________________________________________

Purchaser hereby agrees that should this sale be later held subject to tax, purchaser assumes full liability for the tax.

______________________________________

____________________________ _____/_______/________

Signature of Purchaser

Title

Date

______________________________________

(______)_____________________

Print Purchaser’s Name

Telephone

NOTICE:

Any purchaser and/or agent who fraudulently signs this certificate without intent to use the property or

services purchased as above stated is subject to all the penalties provided for by Title 47 of the Louisiana Revised

Statutes of 1950. This certificate will remain in effect until withdrawn by the purchaser, or the purchaser’s sales tax

account is closed, or the purchaser’s ability to make tax-free purchases is amended or revoked by the Ascension Parish

Sales and Use Tax Authority.

-------------------------------------------------------------------------------------------------------------------------

INSTRUCTIONS - SALES & USE TAX EXEMPTION CERTIFICATE

Use this form to claim exemption from sales tax on purchases of taxable items. The purchaser must complete all fields on the

exemption certificate and provide the fully completed certificate to the seller in order to claim exemption.

Purchaser: You are responsible for ensuring that you are entitled to the exemption you are claiming. It is your responsibility to

inform the seller if any part of the transaction is taxable. You will be held liable for any tax and interest, as well as penalties

imposed by the Ascension Parish Sales and Use Tax Authority, if you are not eligible to claim this exemption.

Seller: You are required to keep a copy of this exemption certificate in your files and provide information on the purchaser to any

local taxing jurisdiction upon request. You are relieved of the responsibility for collecting and remitting sales tax on the sale or sales

described on the exemption certificate, provided all of the following conditions are met:

1.

all fields on the exemption certificate are completed by the purchaser.

2.

the fully completed exemption certificate is provided to you at the time of the sale; and

3.

you do not fraudulently fail to collect the tax due or solicit customers to unlawfully claim an exemption.

Complete the purchaser and seller information section. An identification number for your business must be included. Also, include

your state tax identification number.

This is a local exemption only; state sales tax may apply. A separate state sales tax exemption is required. This exemption applies to

the local sales tax only and cannot be used to exempt the State of Louisiana sales tax.

Proud member of LATA at

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1