Ethanol Producer Report Form - South Dakota

ADVERTISEMENT

Name:

License Number:

Address:

Return Period:

Return Due Date:

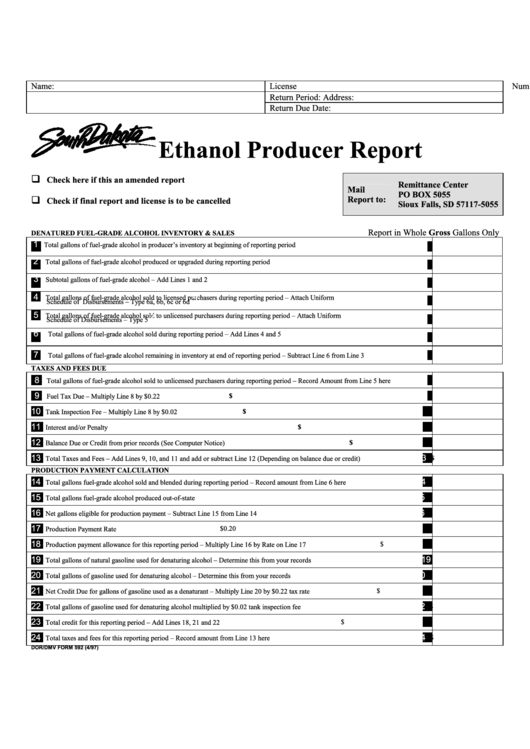

Ethanol Producer Report

Check here if this an amended report

Remittance Center

Mail

PO BOX 5055

Report to:

Check if final report and license is to be cancelled

Sioux Falls, SD 57117-5055

Report in Whole Gross Gallons Only

DENATURED FUEL-GRADE ALCOHOL INVENTORY & SALES

1

1

Total gallons of fuel-grade alcohol in producer’s inventory at beginning of reporting period

2

2

Total gallons of fuel-grade alcohol produced or upgraded during reporting period

3

3

Subtotal gallons of fuel-grade alcohol – Add Lines 1 and 2

4

Total gallons of fuel-grade alcohol sold to licensed purchasers during reporting period – Attach Uniform

4

Schedule of Disbursements – Type 6a, 6b, 6c or 6d

5

Total gallons of fuel-grade alcohol sold to unlicensed purchasers during reporting period – Attach Uniform

5

Schedule of Disbursements – Type 5

6

6

Total gallons of fuel-grade alcohol sold during reporting period – Add Lines 4 and 5

7

7

Total gallons of fuel-grade alcohol remaining in inventory at end of reporting period – Subtract Line 6 from Line 3

TAXES AND FEES DUE

8

8

Total gallons of fuel-grade alcohol sold to unlicensed purchasers during reporting period – Record Amount from Line 5 here

9

9

$

Fuel Tax Due – Multiply Line 8 by $0.22

10

10

$

Tank Inspection Fee – Multiply Line 8 by $0.02

11

11

$

Interest and/or Penalty

12

12

$

Balance Due or Credit from prior records (See Computer Notice)

13

13

$

Total Taxes and Fees – Add Lines 9, 10, and 11 and add or subtract Line 12 (Depending on balance due or credit)

PRODUCTION PAYMENT CALCULATION

14

14

Total gallons fuel-grade alcohol sold and blended during reporting period – Record amount from Line 6 here

15

15

Total gallons fuel-grade alcohol produced out-of-state

16

16

Net gallons eligible for production payment – Subtract Line 15 from Line 14

17

17

$0.20

Production Payment Rate

18

18

$

Production payment allowance for this reporting period – Multiply Line 16 by Rate on Line 17

19

19

Total gallons of natural gasoline used for denaturing alcohol – Determine this from your records

20

20

Total gallons of gasoline used for denaturing alcohol – Determine this from your records

21

21

$

Net Credit Due for gallons of gasoline used as a denaturant – Multiply Line 20 by $0.22 tax rate

22

22

$

Total gallons of gasoline used for denaturing alcohol multiplied by $0.02 tank inspection fee

23

23

$

Total credit for this reporting period – Add Lines 18, 21 and 22

24

24

$

Total taxes and fees for this reporting period – Record amount from Line 13 here

DOR/DMV FORM 592 (4/97)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2