Consumers 4% Tax On Sales And Services Form Alaska

ADVERTISEMENT

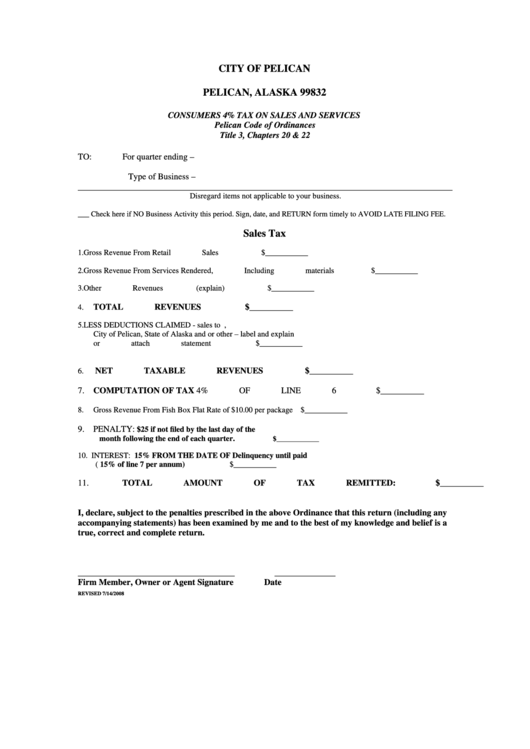

CITY OF PELICAN

P.O. BOX 737

PELICAN, ALASKA 99832

CONSUMERS 4% TAX ON SALES AND SERVICES

Pelican Code of Ordinances

Title 3, Chapters 20 & 22

TO:

For quarter ending –

Type of Business –

______________________________________________________________________________________

Disregard items not applicable to your business.

___ Check here if NO Business Activity this period. Sign, date, and RETURN form timely to AVOID LATE FILING FEE

.

Sales Tax

1.

Gross Revenue From Retail Sales

$___________

2.

Gross Revenue From Services Rendered, Including materials

$___________

3.

Other Revenues (explain)

$___________

TOTAL REVENUES

$__________

4.

5.

LESS DEDUCTIONS CLAIMED - sales to U.S. Government,

City of Pelican, State of Alaska and or other – label and explain

or attach statement

$___________

NET TAXABLE REVENUES

$__________

6.

7. COMPUTATION OF TAX 4% OF LINE 6

$__________

8.

Gross Revenue From Fish Box Flat Rate of $10.00 per package

$___________

9. PENALTY:

$25 if not filed by the last day of the

month following the end of each quarter.

$____________

10. INTEREST: 15% FROM THE DATE OF Delinquency until paid

( 15% of line 7 per annum)

$___________

11. TOTAL AMOUNT OF TAX REMITTED:

$__________

I, declare, subject to the penalties prescribed in the above Ordinance that this return (including any

accompanying statements) has been examined by me and to the best of my knowledge and belief is a

true, correct and complete return.

____________________________________

______________

Firm Member, Owner or Agent Signature

Date

REVISED 7/14/2008

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1