Form Ex-2003 - Extension/exemption Form - Change Of Address/out Of Business

ADVERTISEMENT

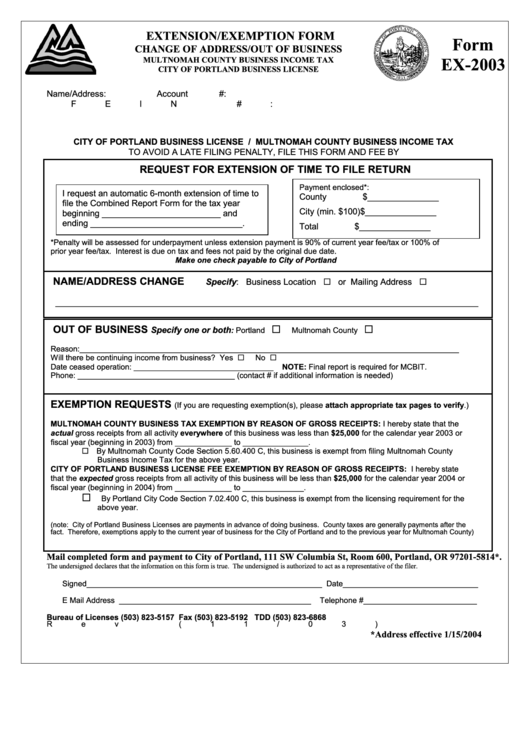

EXTENSION/EXEMPTION FORM

Form

CHANGE OF ADDRESS/OUT OF BUSINESS

MULTNOMAH COUNTY BUSINESS INCOME TAX

EX-2003

CITY OF PORTLAND BUSINESS LICENSE

Name/Address:

Account #:

FEIN #:

CITY OF PORTLAND BUSINESS LICENSE / MULTNOMAH COUNTY BUSINESS INCOME TAX

TO AVOID A LATE FILING PENALTY, FILE THIS FORM AND FEE BY

REQUEST FOR EXTENSION OF TIME TO FILE RETURN

Payment enclosed*:

I request an automatic 6-month extension of time to

County

$_______________

file the Combined Report Form for the tax year

City (min. $100)

$_______________

beginning _________________________ and

ending ________________________________.

Total

$_______________

*Penalty will be assessed for underpayment unless extension payment is 90% of current year fee/tax or 100% of

prior year fee/tax. Interest is due on tax and fees not paid by the original due date.

Make one check payable to City of Portland

NAME/ADDRESS CHANGE

Specify: Business Location

or Mailing Address

_________________________________________________________________________________________

OUT OF BUSINESS

Specify one or both

: Portland

Multnomah County

Reason:_______________________________________________________________________________________

Will there be continuing income from business? Yes

No

Date ceased operation: ________________________________

NOTE: Final report is required for MCBIT.

Phone: ____________________________________ (contact # if additional information is needed)

EXEMPTION REQUESTS

(If you are requesting exemption(s), please attach appropriate tax pages to verify.)

MULTNOMAH COUNTY BUSINESS TAX EXEMPTION BY REASON OF GROSS RECEIPTS: I hereby state that the

actual gross receipts from all activity everywhere of this business was less than $25,000 for the calendar year 2003 or

fiscal year (beginning in 2003) from _____________ to _______________.

By Multnomah County Code Section 5.60.400 C, this business is exempt from filing Multnomah County

Business Income Tax for the above year.

CITY OF PORTLAND BUSINESS LICENSE FEE EXEMPTION BY REASON OF GROSS RECEIPTS: I hereby state

that the expected gross receipts from all activity of this business will be less than $25,000 for the calendar year 2004 or

fiscal year (beginning in 2004) from _____________ to ______________.

By Portland City Code Section 7.02.400 C, this business is exempt from the licensing requirement for the

above year.

(note: City of Portland Business Licenses are payments in advance of doing business. County taxes are generally payments after the

fact. Therefore, exemptions apply to the current year of business for the City of Portland and to the previous year for Multnomah County)

Mail completed form and payment to City of Portland, 111 SW Columbia St, Room 600, Portland, OR 97201-5814*.

The undersigned declares that the information on this form is true. The undersigned is authorized to act as a representative of the filer.

Signed______________________________________________________ Date_______________________________

E Mail Address ____________________________________________

Telephone #__________________________

Bureau of Licenses (503) 823-5157

Fax (503) 823-5192

TDD (503) 823-6868

*Address effective 1/15/2004

Rev (11/03)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1