Form Oq - 2008 - Oregon Quarterly Tax Report

ADVERTISEMENT

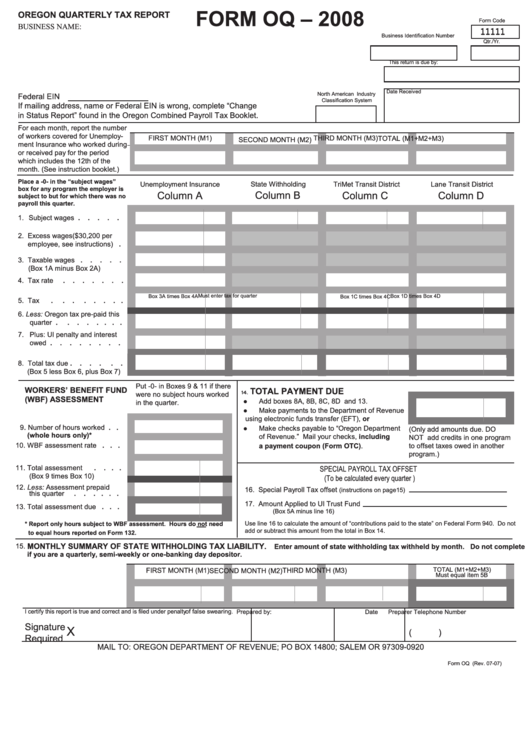

FORM OQ – 2008

OREGON QUARTERLY TAX REPORT

Form Code

BUSINESS NAME:

11111

Business Identification Number

Qtr./Yr.

This return is due by:

Date Received

North American Industry

Federal EIN

Classification System

If mailing address, name or Federal EIN is wrong, complete “Change

in Status Report” found in the Oregon Combined Payroll Tax Booklet.

For each month, report the number

of workers covered for Unemploy-

FIRST MONTH (M1)

THIRD MONTH (M3)

TOTAL (M1+M2+M3)

SECOND MONTH (M2)

ment Insurance who worked during

or received pay for the period

which includes the 12th of the

month. (See instruction booklet.)

Place a -0- in the “subject wages”

Unemployment Insurance

State Withholding

TriMet Transit District

Lane Transit District

box for any program the employer is

Column B

Column C

Column A

Column D

subject to but for which there was no

payroll this quarter.

1. Subject wages .

.

.

.

.

2. Excess wages ($30,200 per

employee, see instructions) .

3. Taxable wages .

.

.

.

.

(Box 1A minus Box 2A)

4. Tax rate

.

.

.

.

.

.

.

Box 3A times Box 4A

Must enter tax for quarter

Box 1D times Box 4D

Box 1C times Box 4C

5. Tax

.

.

.

.

.

.

. .

6. Less: Oregon tax pre-paid this

quarter .

.

.

.

. . . .

7. Plus: UI penalty and interest

owed .

.

.

.

.

.

.

.

8. Total tax due .

.

.

.

.

.

(Box 5 less Box 6, plus Box 7)

Put -0- in Boxes 9 & 11 if there

WORKERS’ BENEFIT FUND

TOTAL PAYMENT DUE

14.

were no subject hours worked

(WBF) ASSESSMENT

Add boxes 8A, 8B, 8C, 8D and 13.

in the quarter.

Make payments to the Department of Revenue

using electronic funds transfer (EFT), or

.

9

Number of hours worked . .

Make checks payable to “Oregon Department

(Only add amounts due. DO

(whole hours only)*

of Revenue.” Mail your checks, including

NOT add credits in one program

10. WBF assessment rate . . .

a payment coupon (Form OTC).

to offset taxes owed in another

program.)

11. Total assessment

.

. . .

SPECIAL PAYROLL TAX OFFSET

(Box 9 times Box 10)

(To be calculated every quarter )

12. Less: Assessment prepaid

16. Special Payroll Tax offset

(instructions on page15)

this quarter

.

.

. . . .

17. Amount Applied to UI Trust Fund

13. Total assessment due . . .

(Box 5A minus line 16)

Use line 16 to calculate the amount of “contributions paid to the state” on Federal Form 940. Do not

* Report only hours subject to WBF assessment. Hours do not need

add or subtract this amount from the total in Box 14.

to equal hours reported on Form 132.

MONTHLY SUMMARY OF STATE WITHHOLDING TAX LIABILITY.

15.

Enter amount of state withholding tax withheld by month. Do not complete

if you are a quarterly, semi-weekly or one-banking day depositor.

TOTAL (M1+M2+M3)

FIRST MONTH (M1)

SECOND MONTH (M2)

THIRD MONTH (M3)

Must equal item 5B

I certify this report is true and correct and is filed under penalty of false swearing.

Date

Preparer Telephone Number

Prepared by:

Signature

X

(

)

Required

MAIL TO: OREGON DEPARTMENT OF REVENUE; PO BOX 14800; SALEM OR 97309-0920

Form OQ (Rev. 07-07)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2