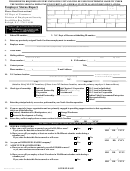

18.

DOMESTIC EMPLOYERS:

Have you or will you pay $1,000 or more in a calendar quarter for domestic

______ /______/ _______

service in a private home, college club, fraternity or sorority? If yes, enter the

Yes

No

MM

DD

YYYY

date this occurred or will occur.

19.

NON-PROFIT ORGANIZATIONS: (Attach a copy of Federal Letter of Exemption under Section 501(c)(3) of the Internal

Revenue Code.)

Have you or will you employ four or more workers in 20 different calendar weeks

during a calendar year? If yes, enter the date this occurred or will occur.

Yes

No

______ /______/ _______

MM

DD

YYYY

20.

GOVERNMENTAL ENTITY:

(check one type below)

Federal

State

Local

Other: ________________________________________

21.

If you are not otherwise subject to the unemployment tax law under one of the preceding criteria (Items 15-

20), do you wish to voluntarily cover your employees for unemployment insurance?

Yes

No

22.

Have you ever paid Federal Unemployment Tax (FUTA)?

Yes

No

If yes, for what year(s)?

________

________

________

________

________

23.

If you have acquired, transferred assets or merged with another business, or made any other changes in the ownership of the

business, including changes, such as from a sole proprietorship to a corporation or a partnership, complete the following:

a.

Name of Former Owner: _____________________________________________________________________________

(Full Organizational Name, including Trade Name)

Former Owner’s N.C. UI Tax Number: _______________________________________

b.

Former Owner’s Address: ________________________________________

__________________

__ __

__________

c.

City

State

Zip Code

Street or P.O. Box

d.

On what date did you acquire or change the business?

______ /______/ _______

MM

DD

YYYY

Did you acquire all or a portion of the former owner’s North Carolina business?

e.

All

Portion (Specify) %______

f.

Was the business in operation at the time you acquired it?

Yes

No

Date Closed

______ /______/ _______

MM

DD

YYYY

g.

Was the business in bankruptcy at the time you acquired it?

Yes

No

h.

Does the former owner continue to have employees in North Carolina?

Yes

No

24.

Do you have workers who perform services for your business whom you consider to be self-employed or

independent contractors? If yes, see instructions for list to be attached.

Yes

No

25.

List owners (parent corporation, sole proprietor, ALL general partners, principal corporate officers, or members.) Attach a list of

those for which there is no space below.

______________________

______________________

_______________________

____________

_____________________

First Name

Middle Name

Last Name

Title

SSN or FEIN

_________________________________________

_______________________

__ __

___________

(____) ____ ______

Street or P.O. Box

City

State

Zip Code

Phone

______________________

______________________

_______________________

____________

_____________________

First Name

Middle Name

Last Name

Title

SSN or FEIN

_________________________________________

_______________________

__ __

__________

(____) ____ ______

Street or P.O. Box

City

State

Zip Code

Phone

______________________

______________________

_______________________

____________

_____________________

First Name

Middle Name

Last Name

Title

SSN or FEIN

_________________________________________

_______________________

__ __

__________

(____) ____ ______

Street or P.O. Box

City

State

Zip Code

Phone

Be Sure That All Applicable Items Are Completed Before Signing

I certify that the information entered on this form is true and accurate, and that I am authorized by the named employing unit to

complete this report for determining unemployment tax liability.

_____________________________________________

___________________________________

______ /______/ ________

Signature

Title

MM

DD

YYYY

NCUI 604 (Rev 02/2012)

1

1 2

2