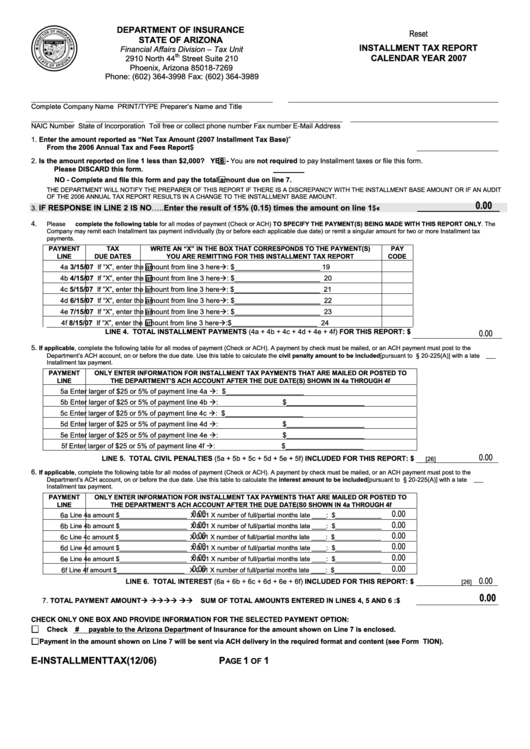

DEPARTMENT OF INSURANCE

Reset

STATE OF ARIZONA

INSTALLMENT TAX REPORT

Financial Affairs Division – Tax Unit

th

CALENDAR YEAR 2007

2910 North 44

Street Suite 210

Phoenix, Arizona 85018-7269

Phone: (602) 364-3998 Fax: (602) 364-3989

Complete Company Name

PRINT/TYPE Preparer’s Name and Title

NAIC Number

State of Incorporation Toll free or collect phone number Fax number

E-Mail Address

1.

Enter the amount reported as “Net Tax Amount (2007 Installment Tax Base)”

From the 2006 Annual Tax and Fees Report ................................................................................................................... $

2.

Is the amount reported on line 1 less than $2,000?

YES - You are not required to pay Installment taxes or file this form.

Please DISCARD this form.

NO - Complete and file this form and pay the total amount due on line 7.

THE DEPARTMENT WILL NOTIFY THE PREPARER OF THIS REPORT IF THERE IS A DISCREPANCY WITH THE INSTALLMENT BASE AMOUNT OR IF AN AUDIT

OF THE 2006 ANNUAL TAX REPORT RESULTS IN A CHANGE TO THE INSTALLMENT BASE AMOUNT.

0.00

IF RESPONSE IN LINE 2 IS NO…..Enter the result of 15% (0.15) times the amount on line 1

3.

..................$

«

4.

Please complete the following table for all modes of payment (Check or ACH) TO SPECIFY THE PAYMENT(S) BEING MADE WITH THIS REPORT ONLY. The

Company may remit each Installment tax payment individually (by or before each applicable due date) or remit a singular amount for two or more Installment tax

payments.

PAYMENT

TAX

WRITE AN “X” IN THE BOX THAT CORRESPONDS TO THE PAYMENT(S)

PAY

LINE

DUE DATES

YOU ARE REMITTING FOR THIS INSTALLMENT TAX REPORT

CODE

4a

3/15/07

If “X”, enter the amount from line 3 here : $______________________

19

4b

4/15/07

If “X”, enter the amount from line 3 here : $______________________

20

4c

If “X”, enter the amount from line 3 here : $______________________

21

5/15/07

4d

6/15/07

If “X”, enter the amount from line 3 here : $______________________

22

4e

7/15/07

If “X”, enter the amount from line 3 here : $______________________

23

4f

If “X”, enter the amount from line 3 here :$______________________

24

8/15/07

0.00

LINE 4. TOTAL INSTALLMENT PAYMENTS (4a + 4b + 4c + 4d + 4e + 4f) FOR THIS REPORT: $

5.

If applicable, complete the following table for all modes of payment (Check or ACH). A payment by check must be mailed, or an ACH payment must post to the

Department’s ACH account, on or before the due date. Use this table to calculate the civil penalty amount to be included [pursuant to A.R.S. § 20-225(A)] with a late

Installment tax payment.

PAYMENT

ONLY ENTER INFORMATION FOR INSTALLMENT TAX PAYMENTS THAT ARE MAILED OR POSTED TO

LINE

THE DEPARTMENT’S ACH ACCOUNT AFTER THE DUE DATE(S) SHOWN IN 4a THROUGH 4f

5a

Enter larger of $25 or 5% of payment line 4a

:

$____________________

5b

Enter larger of $25 or 5% of payment line 4b

:

$____________________

5c

Enter larger of $25 or 5% of payment line 4c

:

$____________________

5d

Enter larger of $25 or 5% of payment line 4d

:

$____________________

5e

Enter larger of $25 or 5% of payment line 4e

:

$____________________

5f

Enter larger of $25 or 5% of payment line 4f

:

$____________________

0.00

LINE 5. TOTAL CIVIL PENALTIES (5a + 5b + 5c + 5d + 5e + 5f) INCLUDED FOR THIS REPORT: $

[26]

6.

If applicable, complete the following table for all modes of payment (Check or ACH). A payment by check must be mailed, or an ACH payment must post to the

Department’s ACH account, on or before the due date. Use this table to calculate the interest amount to be included [pursuant to A.R.S. § 20-225(A)] with a late

Installment tax payment.

PAYMENT

ONLY ENTER INFORMATION FOR INSTALLMENT TAX PAYMENTS THAT ARE MAILED OR POSTED TO

LINE

THE DEPARTMENT’S ACH ACCOUNT AFTER THE DUE DATE(S0 SHOWN IN 4a THROUGH 4f

0.00

0.00

6a

Line 4a amount $___________________ X 0.01 X number of full/partial months late ____: $_____________

0.00

0.00

6b

Line 4b amount $___________________ X 0.01 X number of full/partial months late ____: $_____________

0.00

0.00

6c

Line 4c amount $___________________ X 0.01 X number of full/partial months late ____: $_____________

0.00

0.00

6d

Line 4d amount $___________________ X 0.01 X number of full/partial months late ____: $_____________

0.00

0.00

6e

Line 4e amount $___________________ X 0.01 X number of full/partial months late ____: $_____________

0.00

0.00

6f

Line 4f amount $___________________ X 0.01 X number of full/partial months late ____: $_____________

0.00

LINE 6. TOTAL INTEREST (6a + 6b + 6c + 6d + 6e + 6f) INCLUDED FOR THIS REPORT: $

[26]

0.00

7.

TOTAL PAYMENT AMOUNT

SUM OF TOTAL AMOUNTS ENTERED IN LINES 4, 5 AND 6 : $

CHECK ONLY ONE BOX AND PROVIDE INFORMATION FOR THE SELECTED PAYMENT OPTION:

Check #

payable to the Arizona Department of Insurance for the amount shown on Line 7 is enclosed.

Payment in the amount shown on Line 7 will be sent via ACH delivery in the required format and content (see Form E-ACH.INSTRUCTION).

E-INSTALLMENT TAX (12/06)

P

1

1

AGE

OF

1

1