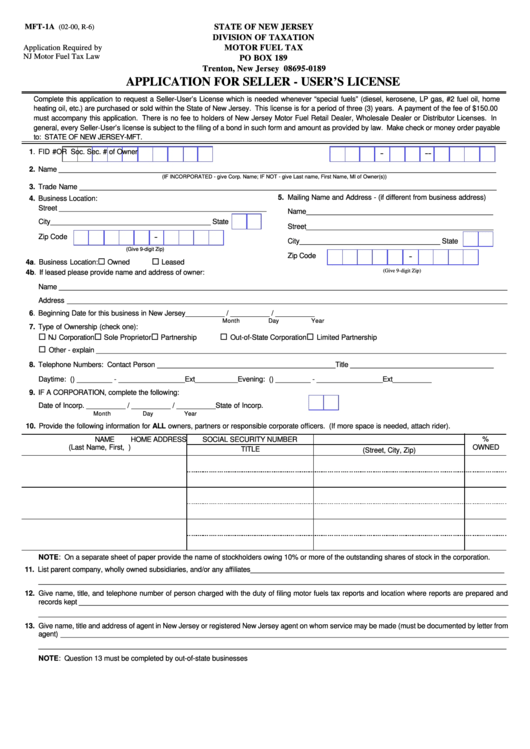

MFT-1A

STATE OF NEW JERSEY

(02-00, R-6)

DIVISION OF TAXATION

Application Required by

MOTOR FUEL TAX

NJ Motor Fuel Tax Law

PO BOX 189

Trenton, New Jersey 08695-0189

APPLICATION FOR SELLER - USER’S LICENSE

Complete this application to request a Seller-User’s License which is needed whenever “special fuels” (diesel, kerosene, LP gas, #2 fuel oil, home

heating oil, etc.) are purchased or sold within the State of New Jersey. This license is for a period of three (3) years. A payment of the fee of $150.00

must accompany this application. There is no fee to holders of New Jersey Motor Fuel Retail Dealer, Wholesale Dealer or Distributor Licenses. In

general, every Seller-User’s license is subject to the filing of a bond in such form and amount as provided by law. Make check or money order payable

to: STATE OF NEW JERSEY-MFT.

1. FID #

-

OR Soc. Sec. # of Owner

-

-

2. Name ________________________________________________________________________________________________________________

(IF INCORPORATED - give Corp. Name; IF NOT - give Last name, First Name, MI of Owner(s))

3. Trade Name ___________________________________________________________________________________________________________

5. Mailing Name and Address - (if different from business address)

4. Business Location:

Street _____________________________________________________

Name________________________________________________

City_________________________________________ State

Street________________________________________________

-

Zip Code

City____________________________________ State

(Give 9-digit Zip)

-

Zip Code

¨

¨

4a. Business Location:

Owned

Leased

(Give 9-digit Zip)

4b. If leased please provide name and address of owner:

Name ___________________________________________________________________________________________________________________

Address _________________________________________________________________________________________________________________

6. Beginning Date for this business in New Jersey

__________ / __________ / __________

Month

Day

Year

7. Type of Ownership (check one):

¨

¨

¨

¨

¨

NJ Corporation

Sole Proprietor

Partnership

Out-of-State Corporation

Limited Partnership

¨

Other - explain _________________________________________________________________________________________________________

8. Telephone Numbers: Contact Person ______________________________________________

Title _____________________________________

Daytime: (

) _________ - _________________Ext___________

Evening: (

) _________ - _________________Ext__________

9. IF A CORPORATION, complete the following:

Date of Incorp. __________ / __________ / __________

State of Incorp.

Month

Day

Year

10. Provide the following information for ALL owners, partners or responsible corporate officers. (If more space is needed, attach rider).

%

NAME

SOCIAL SECURITY NUMBER

HOME ADDRESS

(Last Name, First, M.I.)

OWNED

TITLE

(Street, City, Zip)

NOTE: On a separate sheet of paper provide the name of stockholders owing 10% or more of the outstanding shares of stock in the corporation.

11. List parent company, wholly owned subsidiaries, and/or any affiliates_________________________________________________________________

________________________________________________________________________________________________________________________

12. Give name, title, and telephone number of person charged with the duty of filing motor fuels tax reports and location where reports are prepared and

records kept ______________________________________________________________________________________________________________

________________________________________________________________________________________________________________________

13. Give name, title and address of agent in New Jersey or registered New Jersey agent on whom service may be made (must be documented by letter from

agent) ___________________________________________________________________________________________________________________

________________________________________________________________________________________________________________________

NOTE: Question 13 must be completed by out-of-state businesses

1

1 2

2