Gt-500002 5/2 - Suggested Format For Affidavit For Exemption Of Aircraft Sold For Removal From The State Of Florida By A Nonresident Purchaser Form Page 2

ADVERTISEMENT

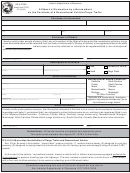

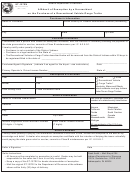

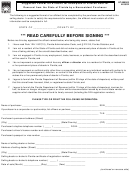

Description of Aircraft

Make __________________________________________

Model _______________________ Year

___________

Serial number ___________________________________

FAA registration number __________________________

(Check one)

New

Used

Purchase

Net purchase

price $ _________________________

Trade-in $ ______________________ price $ ________________________

Primary location of aircraft while in Florida ______________________________________________________________

I claim exemption from Florida sales and use tax on the purchase price of the aircraft described herein under

s. 212.05(1)(a)2, Florida Statutes, for the following reason (check one):

The aircraft will be removed from Florida within 10 days of the date of purchase.

The aircraft requires repairs, additions, or alterations and it will immediately be taken to a repair facility and

will be removed from Florida within 20 days (excluding tolled days) after completion of the work.

Under penalty of perjury, I declare that I have read the foregoing and the facts alleged are true to the best of my

knowledge and belief. I understand that if I fail to comply with the requirements of this affidavit, I will be liable for

payment of the tax and a mandatory penalty equal to the tax.

______________________________________________

Signature of affiant/purchaser

Sworn to (or affirmed) and subscribed before me this day of ____________ , ________ .

_____________________________________________

Signature of Notary

_____________________________________________

Print, type, or stamp name of Notary

Personally known

Produced identification

Type of Identification: _________________________

Distribution of Documents

The original affidavit and a copy of the sales invoice, bill of sale, or closing document must be sent to the Florida

Department of Revenue, Aircraft Enforcement Unit, P.O. Box 6417, Tallahassee FL 32314-6417 within five (5) days of the

date of sale.

A copy of the affidavit must be retained by the selling dealer and made a part of the dealer’s records.

The selling dealer or broker should provide the purchaser with a copy.

Notice To Dealers

Affidavits not filed within five (5) days of the date of sale may not be accepted by the Department of Revenue and

the selling dealer or broker may be billed for tax, penalty, and interest due.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2