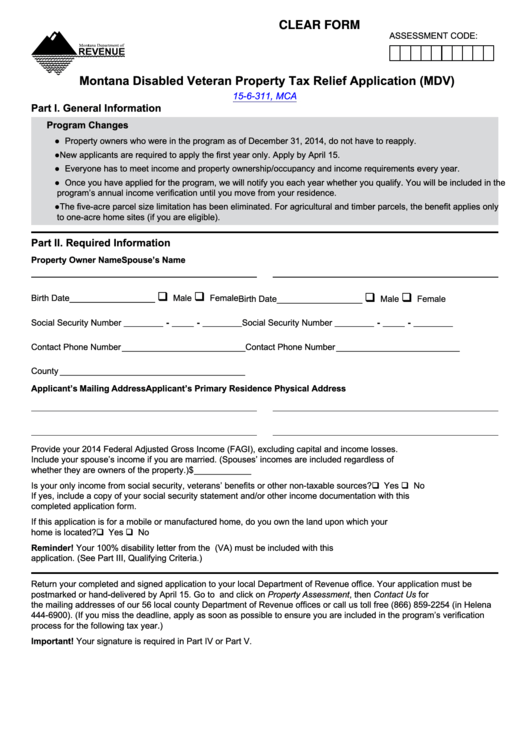

CLEAR FORM

ASSESSMENT CODE:

Montana Disabled Veteran Property Tax Relief Application (MDV)

15-6-311, MCA

Part I. General Information

Program Changes

● Property owners who were in the program as of December 31, 2014, do not have to reapply.

● New applicants are required to apply the first year only. Apply by April 15.

● Everyone has to meet income and property ownership/occupancy and income requirements every year.

● Once you have applied for the program, we will notify you each year whether you qualify. You will be included in the

program’s annual income verification until you move from your residence.

● The five-acre parcel size limitation has been eliminated. For agricultural and timber parcels, the benefit applies only

to one-acre home sites (if you are eligible).

Part II. Required Information

Property Owner Name

Spouse’s Name

q

q

q

q

Birth Date __________________

Male

Female

Birth Date __________________

Male

Female

Social Security Number _________ - _____ - _________

Social Security Number _________ - _____ - _________

Contact Phone Number __________________________

Contact Phone Number __________________________

County _______________________________________

Applicant’s Mailing Address

Applicant’s Primary Residence Physical Address

Provide your 2014 Federal Adjusted Gross Income (FAGI), excluding capital and income losses.

Include your spouse’s income if you are married. (Spouses’ incomes are included regardless of

whether they are owners of the property.) ................................................................................................... $ ____________

Is your only income from social security, veterans’ benefits or other non-taxable sources? .......................q Yes

q No

If yes, include a copy of your social security statement and/or other income documentation with this

completed application form.

If this application is for a mobile or manufactured home, do you own the land upon which your

home is located? .........................................................................................................................................q Yes

q No

Reminder! Your 100% disability letter from the U.S. Department of Veterans Affairs (VA) must be included with this

application. (See Part III, Qualifying Criteria.)

Return your completed and signed application to your local Department of Revenue office. Your application must be

postmarked or hand-delivered by April 15. Go to revenue.mt.gov and click on Property Assessment, then Contact Us for

the mailing addresses of our 56 local county Department of Revenue offices or call us toll free (866) 859-2254 (in Helena

444-6900). (If you miss the deadline, apply as soon as possible to ensure you are included in the program’s verification

process for the following tax year.)

Important! Your signature is required in Part IV or Part V.

1

1 2

2