Election Notice Form - Oregon

ADVERTISEMENT

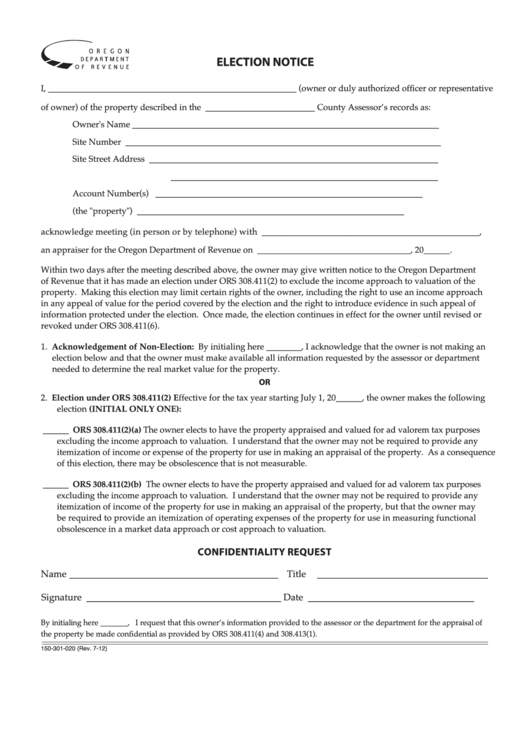

ELECTION NOTICE

I, _________________________________________________________ (owner or duly authorized officer or representative

of owner) of the property described in the _________________________ County Assessor’s records as:

Owner's Name ______________________________________________________________________

Site Number ________________________________________________________________________

Site Street Address __________________________________________________________________

_____________________________________________________________

Account Number(s)

_____________________________________________________________

(the "property")

_____________________________________________________________

acknowledge meeting (in person or by telephone) with ________________________________________________,

an appraiser for the Oregon Department of Revenue on ___________________________________, 20______.

Within two days after the meeting described above, the owner may give written notice to the Oregon Department

of Revenue that it has made an election under ORS 308.411(2) to exclude the income approach to valuation of the

property. Making this election may limit certain rights of the owner, including the right to use an income approach

in any appeal of value for the period covered by the election and the right to introduce evidence in such appeal of

information protected under the election. Once made, the election continues in effect for the owner until revised or

revoked under ORS 308.411(6).

1. Acknowledgement of Non-Election: By initialing here ________, I acknowledge that the owner is not making an

election below and that the owner must make available all information requested by the assessor or department

needed to determine the real market value for the property.

OR

2.

Election under ORS 308.411(2) Effective for the tax year starting July 1, 20______, the owner makes the following

election (INITIAL ONLY ONE):

______ ORS 308.411(2)(a) The owner elects to have the property appraised and valued for ad valorem tax purposes

excluding the income approach to valuation. I understand that the owner may not be required to provide any

itemization of income or expense of the property for use in making an appraisal of the property. As a consequence

of this election, there may be obsolescence that is not measurable.

______ ORS 308.411(2)(b) The owner elects to have the property appraised and valued for ad valorem tax purposes

excluding the income approach to valuation. I understand that the owner may not be required to provide any

itemization of income of the property for use in making an appraisal of the property, but that the owner may

be required to provide an itemization of operating expenses of the property for use in measuring functional

obsolescence in a market data approach or cost approach to valuation.

CONfIdENTIaLITy REquEsT

Name ____________________________________________

Title ____________________________________

Signature _________________________________________

Date ___________________________________

By initialing here _______, I request that this owner’s information provided to the assessor or the department for the appraisal of

the property be made confidential as provided by ORS 308.411(4) and 308.413(1).

150-301-020 (Rev. 7-12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1