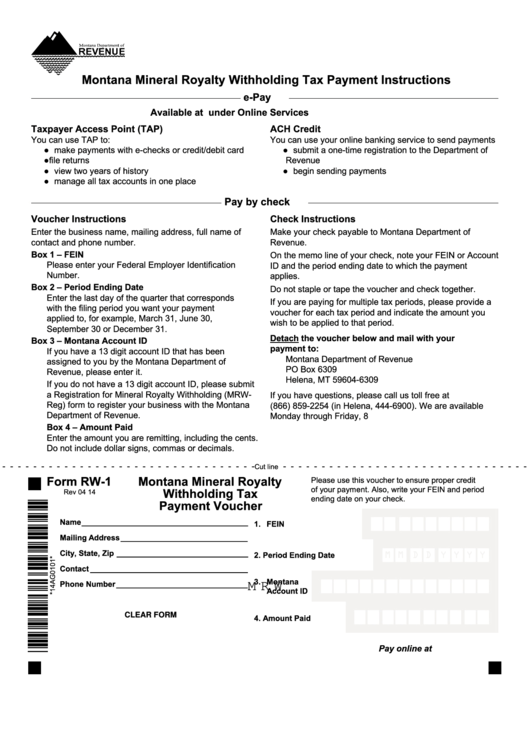

Montana Mineral Royalty Withholding Tax Payment Instructions

e-Pay

Available at revenue.mt.gov under Online Services

Taxpayer Access Point (TAP)

ACH Credit

You can use TAP to:

You can use your online banking service to send payments

● make payments with e-checks or credit/debit card

● submit a one-time registration to the Department of

● file returns

Revenue

● view two years of history

● begin sending payments

● manage all tax accounts in one place

Pay by check

Voucher Instructions

Check Instructions

Enter the business name, mailing address, full name of

Make your check payable to Montana Department of

contact and phone number.

Revenue.

Box 1 – FEIN

On the memo line of your check, note your FEIN or Account

Please enter your Federal Employer Identification

ID and the period ending date to which the payment

Number.

applies.

Box 2 – Period Ending Date

Do not staple or tape the voucher and check together.

Enter the last day of the quarter that corresponds

If you are paying for multiple tax periods, please provide a

with the filing period you want your payment

voucher for each tax period and indicate the amount you

applied to, for example, March 31, June 30,

wish to be applied to that period.

September 30 or December 31.

Detach the voucher below and mail with your

Box 3 – Montana Account ID

payment to:

If you have a 13 digit account ID that has been

Montana Department of Revenue

assigned to you by the Montana Department of

PO Box 6309

Revenue, please enter it.

Helena, MT 59604-6309

If you do not have a 13 digit account ID, please submit

a Registration for Mineral Royalty Withholding (MRW-

If you have questions, please call us toll free at

Reg) form to register your business with the Montana

(866) 859-2254 (in Helena, 444-6900). We are available

Department of Revenue.

Monday through Friday, 8 a.m. to 5 p.m.

Box 4 – Amount Paid

Enter the amount you are remitting, including the cents.

Do not include dollar signs, commas or decimals.

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Cut line

Form RW-1

Montana Mineral Royalty

Please use this voucher to ensure proper credit

of your payment. Also, write your FEIN and period

Withholding Tax

Rev 04 14

ending date on your check.

Payment Voucher

Name ______________________________________

1. FEIN

Mailing Address _____________________________

City, State, Zip ______________________________

M M D D Y Y Y Y

2. Period Ending Date

Contact ____________________________________

3. Montana

M R W

Phone Number ______________________________

Account ID

CLEAR FORM

4. Amount Paid

Pay online at revenue.mt.gov

1

1