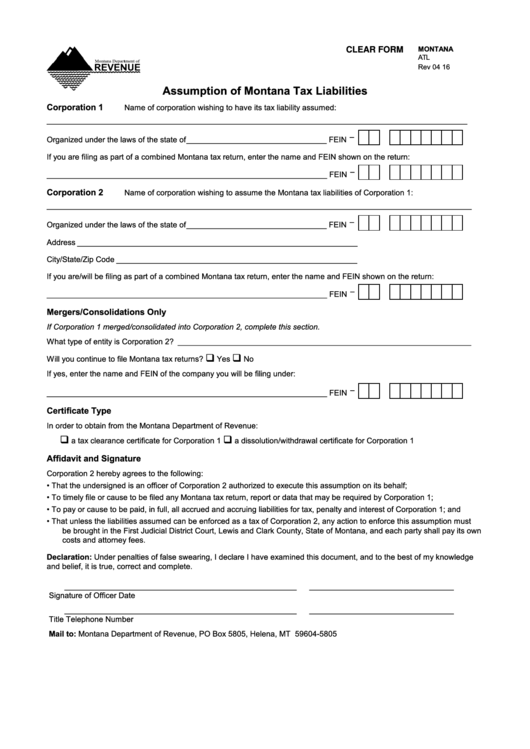

MONTANA

CLEAR FORM

ATL

Rev 04 16

Assumption of Montana Tax Liabilities

Corporation 1

Name of corporation wishing to have its tax liability assumed:

________________________________________________________________________________________________

-

Organized under the laws of the state of ________________________________ FEIN

If you are filing as part of a combined Montana tax return, enter the name and FEIN shown on the return:

-

________________________________________________________________ FEIN

Corporation 2

Name of corporation wishing to assume the Montana tax liabilities of Corporation 1:

_________________________________________________________________________________________________

-

Organized under the laws of the state of ________________________________ FEIN

Address ________________________________________________________________

City/State/Zip Code _______________________________________________________

If you are/will be filing as part of a combined Montana tax return, enter the name and FEIN shown on the return:

-

________________________________________________________________ FEIN

Mergers/Consolidations Only

If Corporation 1 merged/consolidated into Corporation 2, complete this section.

What type of entity is Corporation 2? ___________________________________________________________________

Will you continue to file Montana tax returns?

Yes

No

If yes, enter the name and FEIN of the company you will be filing under:

-

________________________________________________________________ FEIN

Certificate Type

In order to obtain from the Montana Department of Revenue:

a tax clearance certificate for Corporation 1

a dissolution/withdrawal certificate for Corporation 1

Affidavit and Signature

Corporation 2 hereby agrees to the following:

•

That the undersigned is an officer of Corporation 2 authorized to execute this assumption on its behalf;

•

To timely file or cause to be filed any Montana tax return, report or data that may be required by Corporation 1;

•

To pay or cause to be paid, in full, all accrued and accruing liabilities for tax, penalty and interest of Corporation 1; and

•

That unless the liabilities assumed can be enforced as a tax of Corporation 2, any action to enforce this assumption must

be brought in the First Judicial District Court, Lewis and Clark County, State of Montana, and each party shall pay its own

costs and attorney fees.

Declaration: Under penalties of false swearing, I declare I have examined this document, and to the best of my knowledge

and belief, it is true, correct and complete.

_____________________________________________________

_________________________________

Signature of Officer

Date

_____________________________________________________

_________________________________

Title

Telephone Number

Mail to: Montana Department of Revenue, PO Box 5805, Helena, MT 59604-5805

1

1 2

2