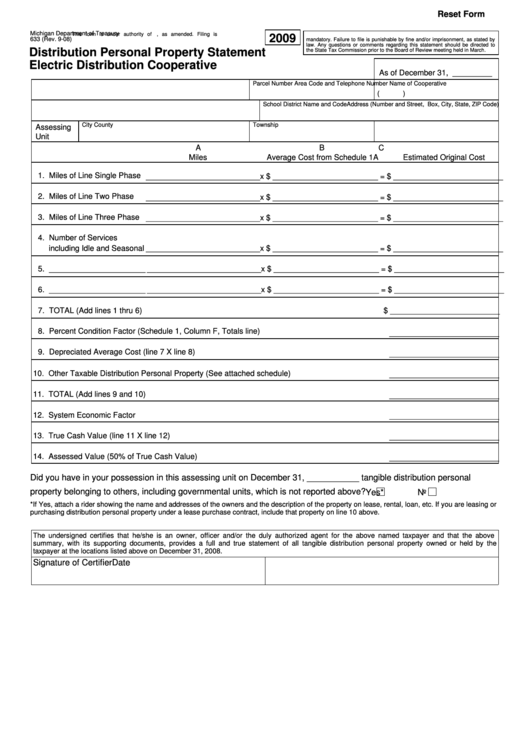

Reset Form

Michigan Department of Treasury

This form is under authority of P.A. 206 of 1893, as amended. Filing is

2009

633 (Rev. 9-08)

mandatory. Failure to file is punishable by fine and/or imprisonment, as stated by

law. Any questions or comments regarding this statement should be directed to

Distribution Personal Property Statement

the State Tax Commission prior to the Board of Review meeting held in March.

Electric Distribution Cooperative

As of December 31, _________

Name of Cooperative

Parcel Number

Area Code and Telephone Number

(

)

Address (Number and Street, P.O. Box, City, State, ZIP Code)

School District Name and Code

City

Township

County

Assessing

Unit

A

B

C

Miles

Average Cost from Schedule 1A

Estimated Original Cost

1. Miles of Line Single Phase

__________________________x $ ________________________ = $ _________________________

2. Miles of Line Two Phase

__________________________x $ ________________________ = $ _________________________

3. Miles of Line Three Phase

__________________________x $ ________________________ = $ _________________________

4. Number of Services

including Idle and Seasonal

__________________________x $ ________________________ = $ _________________________

5. ______________________

__________________________x $ ________________________ = $ _________________________

6. ______________________

__________________________x $ ________________________ = $ _________________________

7. TOTAL (Add lines 1 thru 6)

$ _________________________

8. Percent Condition Factor (Schedule 1, Column F, Totals line)

_________________________

9. Depreciated Average Cost (line 7 X line 8)

_________________________

10. Other Taxable Distribution Personal Property (See attached schedule)

_________________________

11. TOTAL (Add lines 9 and 10)

_________________________

12. System Economic Factor

_________________________

13. True Cash Value (line 11 X line 12)

_________________________

14. Assessed Value (50% of True Cash Value)

_________________________

Did you have in your possession in this assessing unit on December 31, ___________ tangible distribution personal

property belonging to others, including governmental units, which is not reported above?

Yes*

No

*If Yes, attach a rider showing the name and addresses of the owners and the description of the property on lease, rental, loan, etc. If you are leasing or

purchasing distribution personal property under a lease purchase contract, include that property on line 10 above.

The undersigned certifies that he/she is an owner, officer and/or the duly authorized agent for the above named taxpayer and that the above

summary, with its supporting documents, provides a full and true statement of all tangible distribution personal property owned or held by the

taxpayer at the locations listed above on December 31, 2008.

Signature of Certifier

Date

1

1 2

2 3

3 4

4