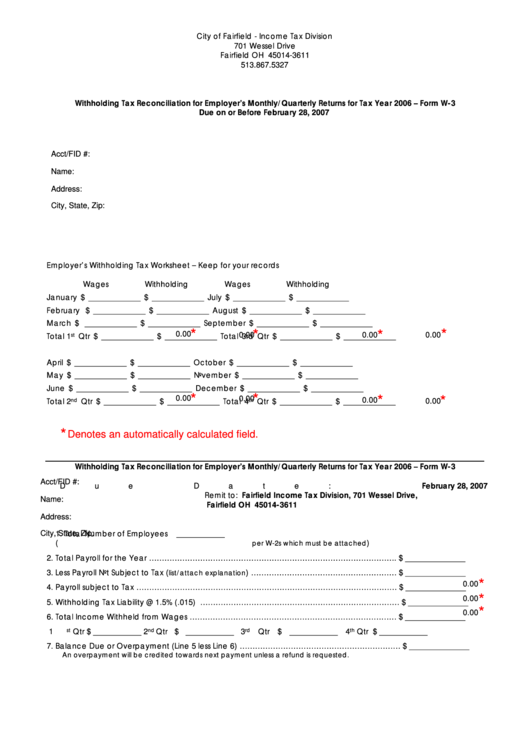

City of Fairfield - Income Tax Division

701 Wessel Drive

Fairfield OH 45014-3611

513.867.5327

Withholding Tax Reconciliation for Employer’s Monthly/Quarterly Returns for Tax Year 2006 – Form W-3

Due on or Before February 28, 2007

Acct/FID #:

Name:

Address:

City, State, Zip:

Employer’s Withholding Tax Worksheet – Keep for your records

Wages

Withholding

Wages

Withholding

January

$ _____________ $ _____________

July

$ _____________ $ _____________

February

$ _____________ $ _____________

August

$ _____________ $ _____________

March

$ _____________ $ _____________

September

$ _____________ $ _____________

*

*

*

*

Total 1

Qtr

$ _____________ $ _____________

0.00

Total 3rd Qtr

$ _____________ $ _____________

st

0.00

0.00

0.00

April

$ _____________ $ _____________

October

$ _____________ $ _____________

May

$ _____________ $ _____________

November

$ _____________ $ _____________

June

$ _____________ $ _____________

December

$ _____________ $ _____________

*

*

0.00

*

*

0.00

Total 2

Qtr

$ _____________ $ _____________

Total 4

Qtr

$ _____________ $ _____________

nd

th

0.00

0.00

*

Denotes an automatically calculated field.

Withholding Tax Reconciliation for Employer’s Monthly/Quarterly Returns for Tax Year 2006 – Form W-3

Acct/FID #:

Due Date: February 28, 2007

Remit to: Fairfield Income Tax Division, 701 Wessel Drive,

Name:

Fairfield OH 45014-3611

Address:

1.

Total Number of Employees

____________

City, State, Zip:

(

)

per W-2s which must be attached

2.

Total Payroll for the Year ……………………………………………………………………………………. $ _______________

3.

Less Payroll Not Subject to Tax (

) ………………………………………………… $ _______________

list/attach explanation

*

0.00

4.

Payroll subject to Tax ………………………………………………………………………………………… $ _______________

*

0.00

5.

Withholding Tax Liability @ 1.5% (.015) …………………………………………………………………… $ _______________

*

0.00

6.

Total Income Withheld from Wages ……………………………………………………………………… $ _______________

1

Qtr

$ ____________ 2

Qtr $ ____________ 3

Qtr $ ____________ 4

Qtr $ ____________

st

nd

rd

th

7.

Balance Due or Overpayment (Line 5 less Line 6) ……………………………………………………… $ _______________

An overpayment will be credited towards next payment unless a refund is requested.

1

1