Form 112-Nfc - Colorado New Business Facilities Credit Form - 1992

ADVERTISEMENT

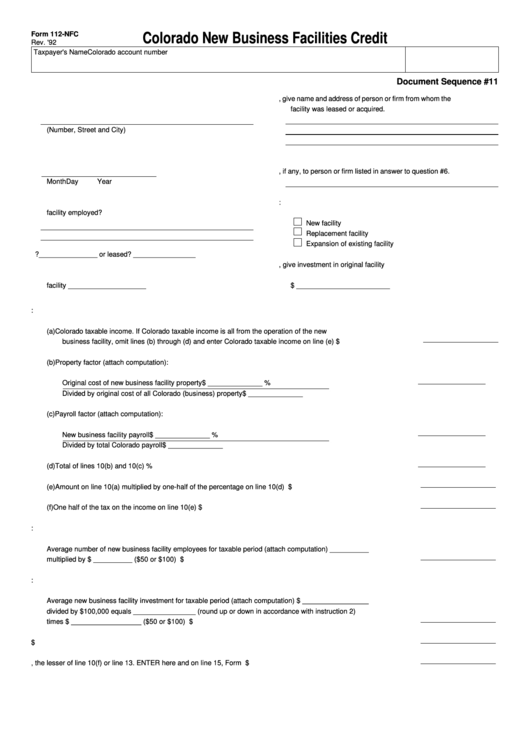

Form 112-NFC

Colorado New Business Facilities Credit

Rev. '92

Taxpayer's Name

Colorado account number

Document Sequence #11

1. Location of qualifying business facility.

6. If applicable, give name and address of person or firm from whom the

facility was leased or acquired.

(Number, Street and City)

2. Date of commencement of commercial operations.

7. Relationship, if any, to person or firm listed in answer to question #6.

Month

Day

Year

3. In what type of revenue producing enterprise is the qualifying business

8. Is the qualifying facility a:

facility employed?

New facility

Replacement facility

Expansion of existing facility

4. Is facility owned?_______________ or leased? ________________

9. If expansion of existing facility, give investment in original facility

5. Number of years credit has previously been claimed in respect to this

facility ____________________

$ ________________________

10. Limitation on credit:

(a) Colorado taxable income. If Colorado taxable income is all from the operation of the new

business facility, omit lines (b) through (d) and enter Colorado taxable income on line (e) ........................................ $

(b) Property factor (attach computation):

Original cost of new business facility property

$ ______________ equals .................................... .

%

Divided by original cost of all Colorado (business) property

$ ______________

(c)

Payroll factor (attach computation):

New business facility payroll

$ ______________ equals .................................... .

%

Divided by total Colorado payroll

$ ______________

(d) Total of lines 10(b) and 10(c) ....................................................................................................................................... .

%

(e) Amount on line 10(a) multiplied by one-half of the percentage on line 10(d) ............................................................... $

(f)

One half of the tax on the income on line 10(e) ............................................................................................................ $

11. Credit for new business facility employees:

Average number of new business facility employees for taxable period (attach computation) __________

multiplied by $ __________ ($50 or $100) equals ................................................................................................................ $

12. Credit for new business facility investment:

Average new business facility investment for taxable period (attach computation) $ _________________

divided by $100,000 equals ________________ (round up or down in accordance with instruction 2)

times $ __________________ ($50 or $100) equals ........................................................................................................... $

13. Total of lines 11 and 12 ........................................................................................................................................................ $

14. New business facility credit, the lesser of line 10(f) or line 13. ENTER here and on line 15, Form 112 ............................... $

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1