Admissions Tax Return Form - City Of Cincinnati

ADVERTISEMENT

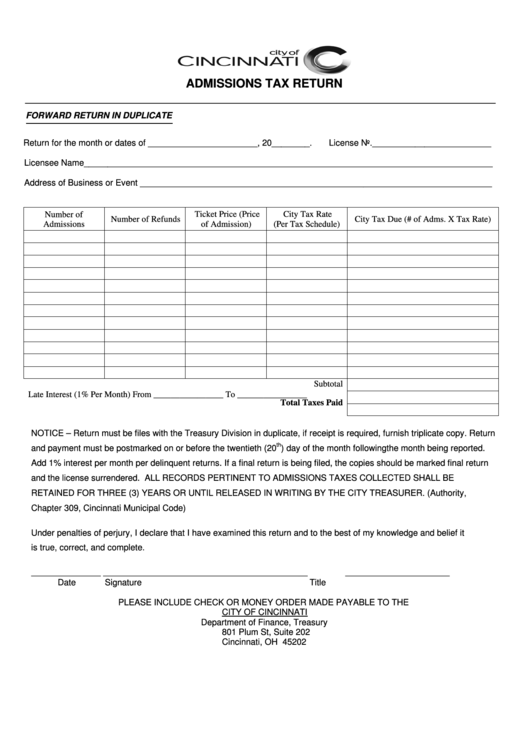

ADMISSIONS TAX RETURN

______________________________________________________________________

FORWARD RETURN IN DUPLICATE

Return for the month or dates of _______________________, 20________.

License No._________________________

Licensee Name______________________________________________________________________________________

Address of Business or Event __________________________________________________________________________

Number of

Ticket Price (Price

City Tax Rate

Number of Refunds

City Tax Due (# of Adms. X Tax Rate)

Admissions

of Admission)

(Per Tax Schedule)

Subtotal

Late Interest (1% Per Month) From ________________ To ________________

Total Taxes Paid

NOTICE – Return must be files with the Treasury Division in duplicate, if receipt is required, furnish triplicate copy. Return

th

and payment must be postmarked on or before the twentieth (20

) day of the month following the month being reported.

Add 1% interest per month per delinquent returns. If a final return is being filed, the copies should be marked final return

and the license surrendered. ALL RECORDS PERTINENT TO ADMISSIONS TAXES COLLECTED SHALL BE

RETAINED FOR THREE (3) YEARS OR UNTIL RELEASED IN WRITING BY THE CITY TREASURER. (Authority,

Chapter 309, Cincinnati Municipal Code)

Under penalties of perjury, I declare that I have examined this return and to the best of my knowledge and belief it

is true, correct, and complete.

________________

_______________________________________________

________________________

Date

Signature

Title

PLEASE INCLUDE CHECK OR MONEY ORDER MADE PAYABLE TO THE

CITY OF CINCINNATI

Department of Finance, Treasury

801 Plum St, Suite 202

Cincinnati, OH 45202

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1