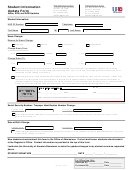

2008 - Information Update Form California Page 2

ADVERTISEMENT

INFORMATION UPDATE FORM INSTRUCTIONS

A.

DBA (Doing Business As)* – If your DBA (Doing Business As) has changed, check box (A) on page 11, Information

Update Form, and provide your new DBA and the date the change took effect.

B.

MAILING ADDRESS* – If the mailing address of your business has changed from that shown on the Renewal Form, check

box (B) on page 11, Information Update Form, and provide the new mailing address and the date the change took effect.

C.

LEGAL NAME* – If the legal name of your business has changed from that shown on the Renewal and Worksheet Forms

(pages 7 & 8) check box (C) on page 11, Information Update Form, and provide the new legal name of your business, tele-

phone number and the date the change took effect.

D.

BUSINESS ADDRESS* – If the address of your business has changed from that shown on the Renewal Form, check box

(D) on page 11, Information Update Form, and provide the new business address and the date the change took effect. If

the new business address is outside of the City of Los Angeles, include the reason for the change and new phone num-

ber in (I). If you have moved out of the City of Los Angeles and solicit or promote business activities within the City of Los

Angeles seven or more days a year, you are required to pay tax. Please review the map of communities on the inside

cover of this booklet. If you have any questions, please call one of the offices listed on the back cover of this booklet.

E.

ALL RENTAL PROPERTY SOLD – This instruction applies only if Class Code 043, “Commercial Rental(s)” or “Hotels/

Apartments, etc.”, business activities are listed on your Renewal Form. (1) If you sold all properties prior to January 1 st

of this year, check box (E) on the Information Update Form (page 11) and provide the date of sale for the properties. (2)

If you sold only a portion of the properties whose rents are included in the above business activities, you still must file a

business tax renewal form. See instruction (H) below. (3) If you sold all properties prior to January 1 st of this year, but

are still engaged in other activities listed on the Renewal Form, see instruction (G). (4) If you sold all properties prior

to January 1 st of this year but the above business activity(ies) was new for last year, complete the Tax Worksheet and

enter the amount of tax from Column J only on the Renewal Form. (5) If you were not in business for Class Code 043

last year, check box (E) on Information Update Form (page 11) and provide the end date for the activities. Enter your Basis

for Tax on the appropriate line number in Column E on the Tax Worksheet, but leave Column K, Tax Due, blank.

F.

ENTIRE BUSINESS SOLD OR DISCONTINUED – If you sold or discontinued all activities listed on the Renewal Form on

page 7 prior to January 1st of this year, check box (F) on page 11 Information Update Form and provide the effective date

of the end of business and complete section (I). If none of your business activities were new for last year, enter your basis

for tax on the appropriate line(s) in Column E lines 8-15 on the Renewal Form, but leave Column K, Tax Due blank. If any

of your business activities were new for last year, complete the Tax Worksheet for the activity and enter the amount of tax

from Column J only in Column K of the Renewal Form.

G.

INDIVIDUAL BUSINESS ACTIVITY SOLD, DISCONTINUED, OR TRANSFERRED – If your business is still in operation

but you have sold or completely discontinued one or more of the business activities listed on the Renewal Form prior to

January 1 st of this year, check box (G) on page 11, Information Update Form and list the ceased activity(ies) and the effec-

tive date(s). Be sure to indicate the affected class code(s). If the activity(ies) which ended was(were) not new last year,

enter your basis for tax on the appropriate line(s) in Column E, Basis for Tax, lines 8-15 on the Renewal Form, but leave

Column K, Tax Due blank. If the activity(ies) which ended was(were) new last year, complete the Tax Worksheet for the

activity(ies) and enter the amount of tax from Tax Worksheet Column J only in Column K of the Renewal Form.

H.

PORTION OF BUSINESS ACTIVITY SOLD OR TRANSFERRED – If you SOLD OR TRANSFERRED only a portion or

part of a business activity to another person, (and did not simply discontinue or cease it) prior to January 1 st of this year,

you may exclude from your Basis for Tax the gross receipts of that portion of the business activity which you sold or trans-

ferred, if such excluded gross receipts can be clearly identified. Check box (H) on page 11, Information Update Form, and

provide the class code(s) and effective date(s). Include in your Basis for Tax, in Column E of the Renewal Form, only the

gross receipts from the continuing portion of the business activity.

I.

BUSINESS RELOCATED OUT OF CITY – If your business relocated outside the City of Los Angeles, please, check box

(I.) on page 11 and provide the primary reason(s) for relocating outside the City and a telephone number where you can

be reached. If you do not plan to continue conducting business in the City, provide the date you last provided service in

the City.

J.

FISCAL YEAR FILING – To begin reporting on a fiscal year basis check box (J) on page 11, Information Update Form,

and provide the beginning and ending dates of your fiscal year.

K.

FISCAL YEAR FILING – To change your previously reported fiscal year, check box (K) on page 11, Information Update

Form, and provide the revised beginning and ending dates of your fiscal year.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3