Form 58-Es Partnership Estimated Tax Payment 2007

ADVERTISEMENT

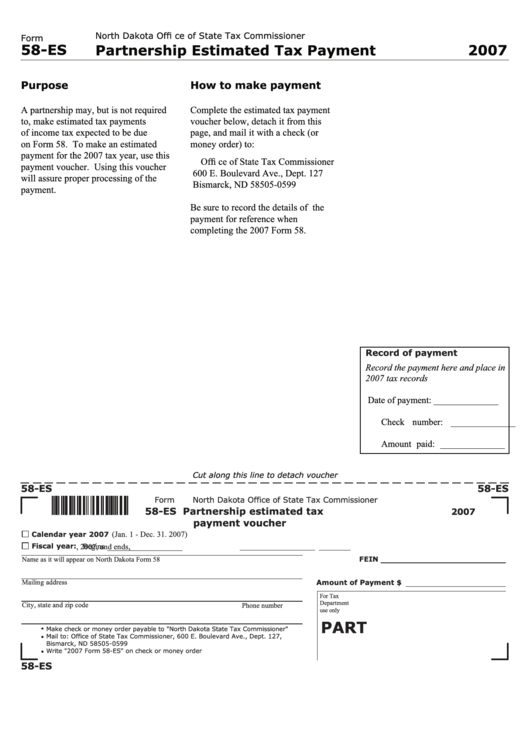

North Dakota Offi ce of State Tax Commissioner

Form

58-ES

Partnership Estimated Tax Payment

2007

Purpose

How to make payment

A partnership may, but is not required

Complete the estimated tax payment

to, make estimated tax payments

voucher below, detach it from this

of income tax expected to be due

page, and mail it with a check (or

on Form 58. To make an estimated

money order) to:

payment for the 2007 tax year, use this

Offi ce of State Tax Commissioner

payment voucher. Using this voucher

600 E. Boulevard Ave., Dept. 127

will assure proper processing of the

Bismarck, ND 58505-0599

payment.

Be sure to record the details of the

payment for reference when

completing the 2007 Form 58.

Record of payment

Record the payment here and place in

2007 tax records

Date of payment: ______________

Check number: ______________

Amount paid: ______________

Cut along this line to detach voucher

58-ES

58-ES

Form

North Dakota Office of State Tax Commissioner

58-ES

Partnership estimated tax

2007

payment voucher

Calendar year 2007

(Jan. 1 - Dec. 31. 2007)

Fiscal year:

,

Begins

, 2007, and ends

FEIN

Name as it will appear on North Dakota Form 58

Mailing address

Amount of Payment $

For Tax

Department

City, state and zip code

Phone number

use only

PART

•

Make check or money order payable to "North Dakota State Tax Commissioner"

•

Mail to: Office of State Tax Commissioner, 600 E. Boulevard Ave., Dept. 127,

Bismarck, ND 58505-0599

•

Write "2007 Form 58-ES" on check or money order

58-ES

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1