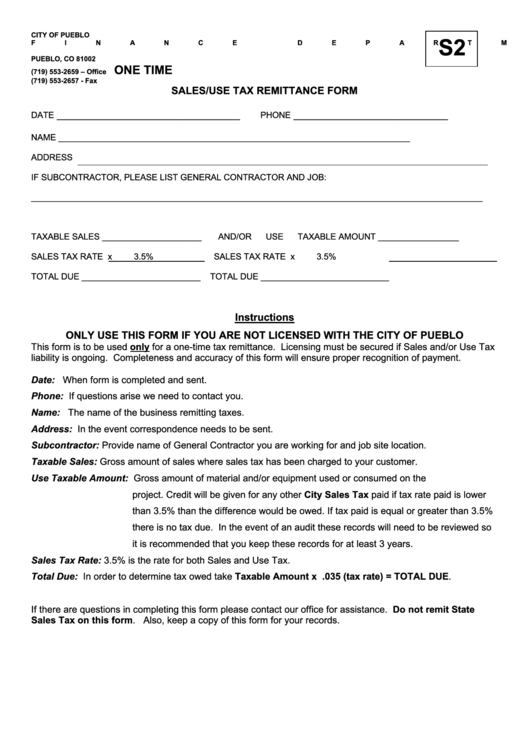

CITY OF PUEBLO

S2

FINANCE DEPARTMENT-SALES TAX DIVISION

P.O. BOX 1427

PUEBLO, CO 81002

ONE TIME

(719) 553-2659 – Office

(719) 553-2657 - Fax

SALES/USE TAX REMITTANCE FORM

________________________________

___________________________

DATE

PHONE

NAME __________________________________________________________________________

ADDRESS

IF SUBCONTRACTOR, PLEASE LIST GENERAL CONTRACTOR AND JOB:

_______________________________________________________________________________________________

TAXABLE SALES _____________________

AND/OR

USE TAXABLE AMOUNT _________________

SALES TAX RATE x

3.5%

SALES TAX RATE x

3.5%

TOTAL DUE _________________________

TOTAL DUE ___________________________

Instructions

ONLY USE THIS FORM IF YOU ARE NOT LICENSED WITH THE CITY OF PUEBLO

This form is to be used only for a one-time tax remittance. Licensing must be secured if Sales and/or Use Tax

liability is ongoing. Completeness and accuracy of this form will ensure proper recognition of payment.

Date:

When form is completed and sent.

Phone:

If questions arise we need to contact you.

Name:

The name of the business remitting taxes.

Address:

In the event correspondence needs to be sent.

Subcontractor:

Provide name of General Contractor you are working for and job site location.

Taxable Sales:

Gross amount of sales where sales tax has been charged to your customer.

Use Taxable Amount: Gross amount of material and/or equipment used or consumed on the

project. Credit will be given for any other City Sales Tax paid if tax rate paid is lower

than 3.5% than the difference would be owed. If tax paid is equal or greater than 3.5%

there is no tax due. In the event of an audit these records will need to be reviewed so

it is recommended that you keep these records for at least 3 years.

Sales Tax Rate:

3.5% is the rate for both Sales and Use Tax.

Total Due:

In order to determine tax owed take Taxable Amount x .035 (tax rate) = TOTAL DUE.

If there are questions in completing this form please contact our office for assistance. Do not remit State

Sales Tax on this form. Also, keep a copy of this form for your records.

1

1