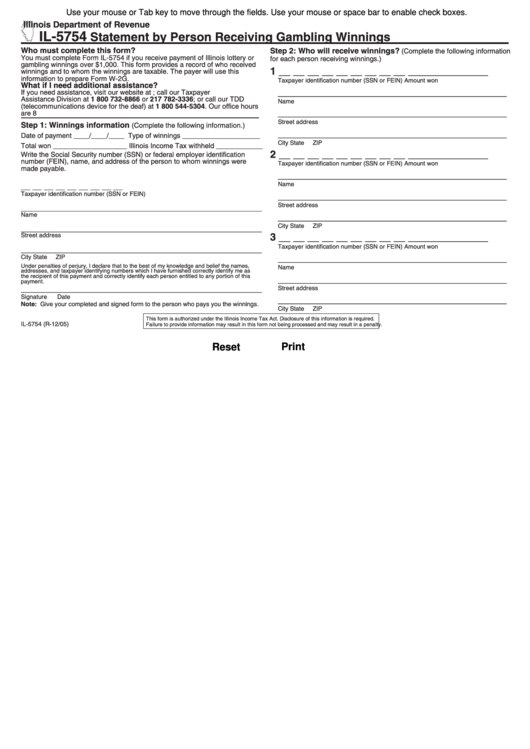

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

IL-5754

Statement by Person Receiving Gambling Winnings

Who must complete this form?

Step 2: Who will receive winnings?

(Complete the following information

You must complete Form IL-5754 if you receive payment of Illinois lottery or

for each person receiving winnings.)

gambling winnings over $1,000. This form provides a record of who received

1 __ __ __ __ __ __ __ __ __

______________

winnings and to whom the winnings are taxable. The payer will use this

information to prepare Form W-2G.

Taxpayer identification number (SSN or FEIN)

Amount won

What if I need additional assistance?

________________________________________

If you need assistance, visit our website at tax.illinois.gov; call our Taxpayer

Assistance Division at 1 800 732-8866 or 217 782-3336; or call our TDD

Name

(telecommunications device for the deaf) at 1 800 544-5304. Our office hours

________________________________________

are 8 a.m. to 5 p.m.

Street address

Step 1: Winnings information

(Complete the following information.)

________________________________________

Date of payment ____/____/____ Type of winnings ____________________

City

State

ZIP

Total won ___________________ Illinois Income Tax withheld ____________

2 __ __ __ __ __ __ __ __ __

______________

Write the Social Security number (SSN) or federal employer identification

number (FEIN), name, and address of the person to whom winnings were

Taxpayer identification number (SSN or FEIN)

Amount won

made payable.

________________________________________

Name

__ __ __ __ __ __ __ __ __

________________________________________

Taxpayer identification number (SSN or FEIN)

Street address

_______________________________________________________

________________________________________

Name

City

State

ZIP

_______________________________________________________

3 __ __ __ __ __ __ __ __ __

______________

Street address

Taxpayer identification number (SSN or FEIN)

Amount won

_______________________________________________________

________________________________________

City

State

ZIP

Under penalties of perjury, I declare that to the best of my knowledge and belief the names,

Name

addresses, and taxpayer identifying numbers which I have furnished correctly identify me as

________________________________________

the recipient of this payment and correctly identify each person entitled to any portion of this

payment.

Street address

_______________________________________________________

Signature

Date

________________________________________

Note: Give your completed and signed form to the person who pays you the winnings.

City

State

ZIP

This form is authorized under the Illinois Income Tax Act. Disclosure of this information is required.

IL-5754 (R-12/05)

Failure to provide information may result in this form not being processed and may result in a penalty.

Reset

Print

1

1