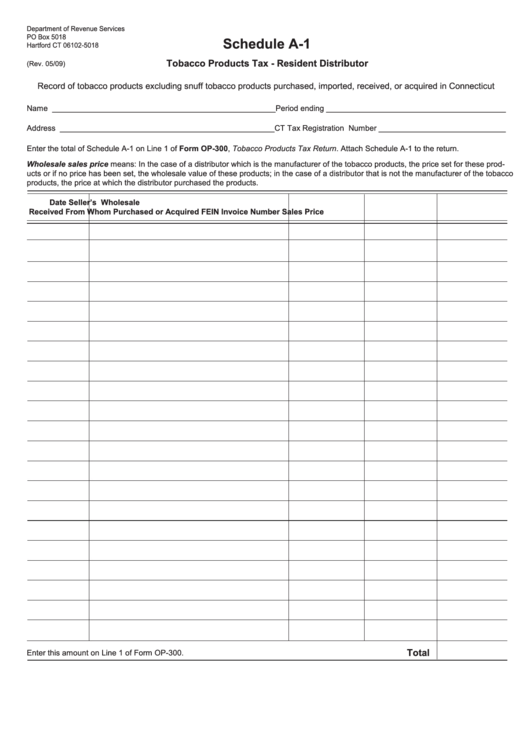

Schedule A-1 - Tobacco Products Tax - Resident Distributor Form

ADVERTISEMENT

Department of Revenue Services

PO Box 5018

Schedule A-1

Hartford CT 06102-5018

Tobacco Products Tax - Resident Distributor

(Rev. 05/09)

Record of tobacco products excluding snuff tobacco products purchased, imported, received, or acquired in Connecticut

Name ___________________________________________________Period ending _________________________________________

Address _________________________________________________CT Tax Registration Number _____________________________

Enter the total of Schedule A-1 on Line 1 of Form OP-300, Tobacco Products Tax Return. Attach Schedule A-1 to the return.

Wholesale sales price means: In the case of a distributor which is the manufacturer of the tobacco products, the price set for these prod-

ucts or if no price has been set, the wholesale value of these products; in the case of a distributor that is not the manufacturer of the tobacco

products, the price at which the distributor purchased the products.

Date

Seller’s

Wholesale

Received

From Whom Purchased or Acquired

FEIN

Invoice Number

Sales Price

Total

Enter this amount on Line 1 of Form OP-300.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1