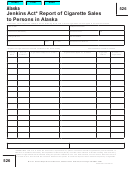

GENERAL INFORMATION

Who Must File: This report must be filed by any person (including a delivery seller) who sells, transfers, or ships cigarettes

or smokeless tobacco for profit into Alabama. The report is due by the 10th day of the month and must show quantities of

cigarettes or smokeless tobacco for each and every shipment made during the previous calendar month.

The information on this report must be organized by the State, and within the State, by the city or town and by zip code, into

which the delivery sale is so made.

Records must be retained until the end of the fourth full calendar year that begins after the date of the delivery sale.

State and county excise tax must be paid to the tax administrator and any required stamps affixed or applied prior to distri-

bution. Exception: Smokeless tobacco tax shall be remitted by the delivery seller to the tax administrator. This tax is due by

the 20th of the month following the previous calendar month's activity. Use forms TOB:OTP to file and remit state tobacco

taxes and form TOB:TTCO-A to file and remit state-administered county tobacco taxes.

DEFINITIONS

Delivery Seller: Means a person who makes a delivery sale.

Delivery Sale: Means any sale of cigarettes or smokeless tobacco to a consumer if: (A) the consumer submits the order for

the sale by means of a telephone or other method of voice transmission, the mails, or the Internet or other online service, or

the seller is otherwise not in the physical presence of the buyer when the request for purchase or order is made; or (B) the

cigarettes or smokeless tobacco are delivered to the buyer by common carrier, private delivery service, or other method of

remote delivery, or the seller is not in the physical presence of the buyer when the buyer obtains possession of the ciga-

rettes or smokeless tobacco.

Cigarette: Any roll of tobacco wrapped in paper or in any substance not containing tobacco; and any roll of tobacco

wrapped in any substance containing tobacco which, because of its appearance, the type of tobacco used in the filler or its

packaging and labeling, is likely to be offered to, or purchased by, consumers as a cigarette. (The term "cigarette" includes

roll-your-own tobacco. The term "cigarette" does not include a cigar as defined in Section 5702 of the Internal Revenue

Code of 1986.)

Consumer: Means any person that purchases cigarettes or smokeless tobacco; and does not include any person lawfully

operating as a manufacturer, distributor, wholesaler, or retailer of cigarettes or smokeless tobacco.

Smokeless Tobacco: As defined in the PACT Act, means any finely cut, ground, powdered, or leaf tobacco, or other prod-

uct containing tobacco, that is intended to be placed in the oral or nasal cavity or otherwise consumed without being com-

busted. As defined in Section 5702 of the Internal Revenue Code of 1986, smoking tobacco means any snuff or chewing

tobacco.

Snuff: Means any finely cut, ground or powdered tobacco that is not intended to be smoked.

Chewing Tobacco: Means any leaf tobacco that is not intended to be smoked.

Roll-your-own Tobacco: Means any tobacco which, because of its appearance, type, packaging, or labeling, is suitable for

use and likely to be offered to, or purchased by, consumers as tobacco for making cigarettes.

INSTRUCTIONS

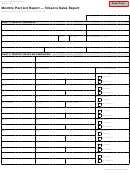

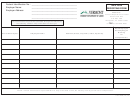

Invoice Date: Enter the date of the invoice.

Invoice Number: Enter the invoice number.

Cigarettes/Smokeless Tobacco shipped to Name: Enter name of entity to whom cigarettes or smokeless tobacco were

distributed.

Cigarettes/Smokeless Tobacco shipped to Address: Enter address of entity to whom cigarettes were distributed. Show

Street, City, State and Zip (Note: Information must be in order by city and zip).

Brand: Enter brand name of cigarettes, RolI-Your-Own (R-Y-O) and smokeless tobacco distributed into Alabama. (Note: Do

not show the brand name by sub-categories such as, regular, menthol, light, etc.)

Number of Cigarettes: Enter number of cigarettes per the invoice and brand.

Quantity (Weight) of R-Y-O: Enter total weight of R-Y-O per the invoice and brand.

Quantity (Weight) of Smokeless Tobacco: Enter total weight of smokeless tobacco per the invoice and brand. This should

be broken out by type of product distributed (snuff or chewing tobacco).

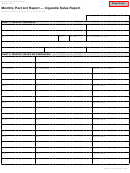

Shipper's Name: Enter name of common carrier or other delivery service that delivered the tobacco products into

Alabama.

Shipper's Address: Enter address of common carrier or other delivery service that delivered the tobacco products into

Alabama.

Shipper's Phone Number: Enter phone number of common carrier or other delivery service that delivered the tobacco

products into Alabama.

1

1 2

2