Employer'S Withholding Tax Return Form - Springboro Income Tax Office

ADVERTISEMENT

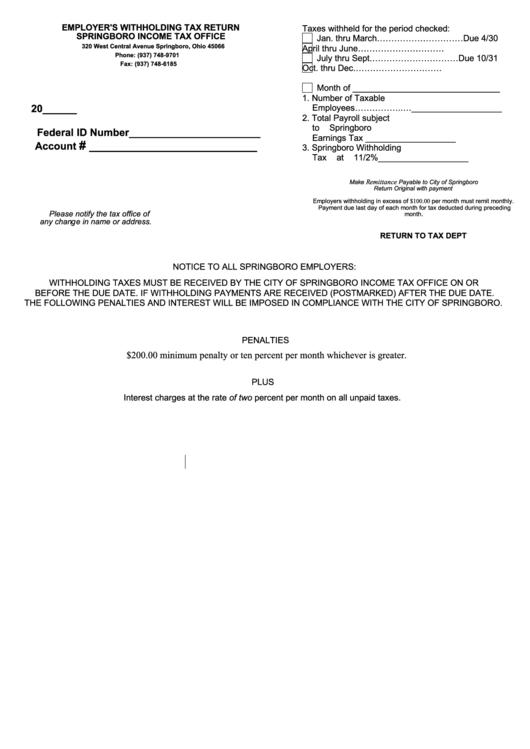

EMPLOYER'S WITHHOLDING TAX RETURN

Taxes withheld for the period checked:

SPRINGBORO INCOME TAX OFFICE

Jan. thru March…………………………Due 4/30

320 West Central Avenue Springboro, Ohio 45066

April thru June…………………………..Due 7/31

Phone: (937) 748-9701

July thru Sept.…………………………Due 10/31

Fax: (937) 748-6185

Oct. thru Dec.…………………………...Due 1/31

Month of _______________________________

1. Number of Taxable

20______

Employees……………..…___________________

2. Total Payroll subject

to Springboro

Federal ID Number_______________________

Earnings Tax ...................___________________

# _________________________

Account

3. Springboro Withholding

Tax at 11/2%....................___________________

Remittance

Make

Payable to City of Springboro

Return Original with payment

Employers withholding in excess of $100.00 per month must remit monthly.

Payment due last day of each month for tax deducted during preceding

Please notify the tax office of

month.

any change in name or address.

RETURN TO TAX DEPT

NOTICE TO ALL SPRINGBORO EMPLOYERS:

WITHHOLDING TAXES MUST BE RECEIVED BY THE CITY OF SPRINGBORO INCOME TAX OFFICE ON OR

BEFORE THE DUE DATE. IF WITHHOLDING PAYMENTS ARE RECEIVED (POSTMARKED) AFTER THE DUE DATE.

THE FOLLOWING PENALTIES AND INTEREST WILL BE IMPOSED IN COMPLIANCE WITH THE CITY OF SPRINGBORO.

PENALTIES

$200.00 minimum penalty or ten percent per month whichever is greater.

PLUS

Interest charges at the rate of two percent per month on all unpaid taxes.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1