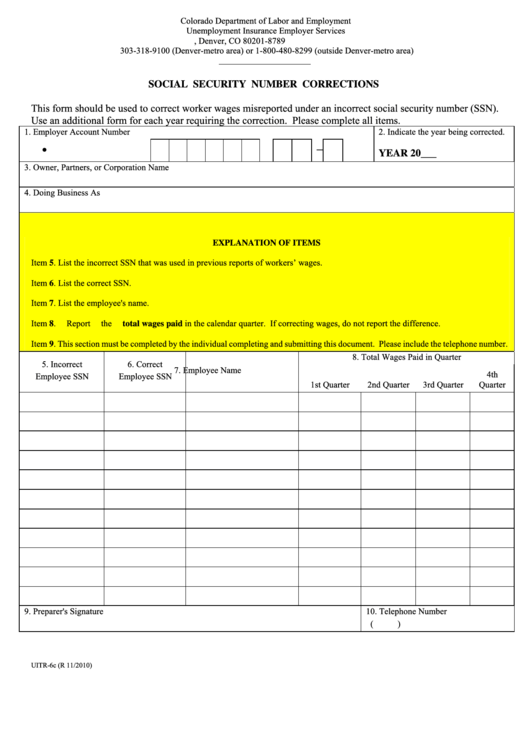

Form Uitr-6c - Social Security Number Corrections

ADVERTISEMENT

Colorado Department of Labor and Employment

Unemployment Insurance Employer Services

P.O. Box 8789, Denver, CO 80201-8789

303-318-9100 (Denver-metro area) or 1-800-480-8299 (outside Denver-metro area)

SOCIAL SECURITY NUMBER CORRECTIONS

This form should be used to correct worker wages misreported under an incorrect social security number (SSN).

Use an additional form for each year requiring the correction. Please complete all items.

1. Employer Account Number

2. Indicate the year being corrected.

●

―

YEAR 20___

3. Owner, Partners, or Corporation Name

4. Doing Business As

EXPLANATION OF ITEMS

Item 5.

List the incorrect SSN that was used in previous reports of workers’ wages.

Item 6.

List the correct SSN.

Item 7.

List the employee's name.

Item 8.

Report the total wages paid in the calendar quarter. If correcting wages, do not report the difference.

Item 9.

This section must be completed by the individual completing and submitting this document. Please include the telephone number.

8. Total Wages Paid in Quarter

5. Incorrect

6. Correct

7. Employee Name

4th

Employee SSN

Employee SSN

1st Quarter

2nd Quarter

3rd Quarter

Quarter

9. Preparer's Signature

10. Telephone Number

(

)

UITR-6c (R 11/2010)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1