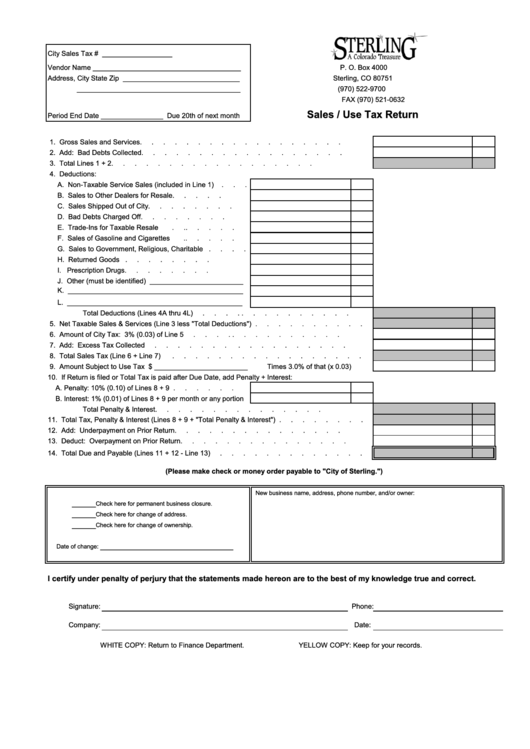

Sales / Use Tax Return Form

ADVERTISEMENT

City Sales Tax # __________________

Vendor Name ______________________________________

P. O. Box 4000

Address, City State Zip ______________________________

Sterling, CO 80751

__________________________________________

(970) 522-9700

FAX (970) 521-0632

Sales / Use Tax Return

Period End Date ________________ Due 20th of next month

1. Gross Sales and Services

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2. Add: Bad Debts Collected

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3. Total Lines 1 + 2

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4. Deductions:

A. Non-Taxable Service Sales (included in Line 1)

.

.

.

B. Sales to Other Dealers for Resale

.

.

.

.

.

C. Sales Shipped Out of City

.

.

.

.

.

.

.

.

D. Bad Debts Charged Off

.

.

.

.

.

.

.

.

E. Trade-Ins for Taxable Resale

.

.

.

.

.

.

.

F. Sales of Gasoline and Cigarettes

.

.

.

.

.

.

G. Sales to Government, Religious, Charitable .

.

.

.

H. Returned Goods

.

.

.

.

.

.

.

.

I. Prescription Drugs

.

.

.

.

.

.

.

.

J. Other (must be identified) ________________________

K. _____________________________________________

L. _____________________________________________

Total Deductions (Lines 4A thru 4L)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5. Net Taxable Sales & Services (Line 3 less "Total Deductions") .

.

.

.

.

.

.

.

.

.

6. Amount of City Tax: 3% (0.03) of Line 5

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7. Add: Excess Tax Collected

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8. Total Sales Tax (Line 6 + Line 7)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9. Amount Subject to Use Tax $ ________________________

Times 3.0% of that (x 0.03)

10. If Return is filed or Total Tax is paid after Due Date, add Penalty + Interest:

A. Penalty: 10% (0.10) of Lines 8 + 9 .

.

.

.

.

.

B. Interest: 1% (0.01) of Lines 8 + 9 per month or any portion

Total Penalty & Interest

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

11. Total Tax, Penalty & Interest (Lines 8 + 9 + "Total Penalty & Interest") .

.

.

.

.

.

.

.

12. Add: Underpayment on Prior Return

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

13. Deduct: Overpayment on Prior Return

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

14. Total Due and Payable (Lines 11 + 12 - Line 13)

.

.

.

.

.

.

.

.

.

.

.

.

.

(Please make check or money order payable to "City of Sterling.")

New business name, address, phone number, and/or owner:

_____

Check here for permanent business closure.

_____

Check here for change of address.

_____

Check here for change of ownership.

____________________________

Date of change:

I certify under penalty of perjury that the statements made hereon are to the best of my knowledge true and correct.

Signature:

Phone:

Company:

Date:

WHITE COPY: Return to Finance Department.

YELLOW COPY: Keep for your records.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1