Business Questionnaire Form Oregon

ADVERTISEMENT

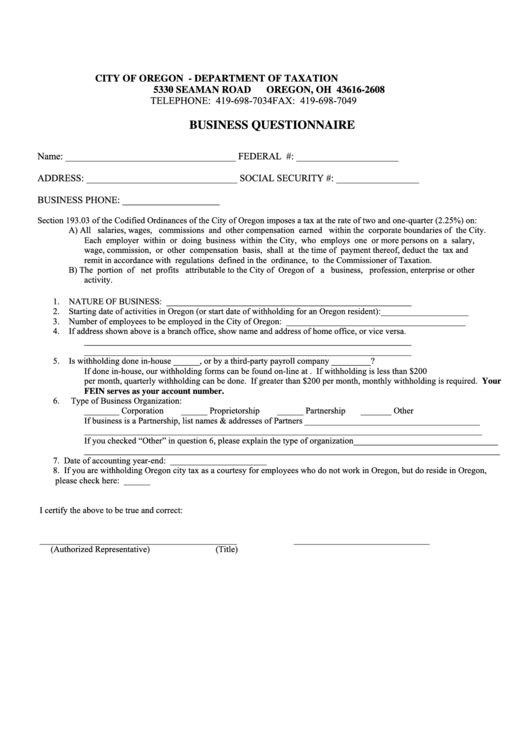

CITY OF OREGON - DEPARTMENT OF TAXATION

5330 SEAMAN ROAD

OREGON, OH 43616-2608

TELEPHONE: 419-698-7034

FAX: 419-698-7049

BUSINESS QUESTIONNAIRE

Name: ___________________________________ FEDERAL I.D. #: _____________________

ADDRESS: _______________________________ SOCIAL SECURITY #: _________________

BUSINESS PHONE: ____________________

Section 193.03 of the Codified Ordinances of the City of Oregon imposes a tax at the rate of two and one-quarter (2.25%) on:

A) All salaries, wages, commissions and other compensation earned within the corporate boundaries of the City.

Each employer within or doing business within the City, who employs one or more persons on a salary,

wage, commission, or other compensation basis, shall at the time of payment thereof, deduct the tax and

remit in accordance with regulations defined in the ordinance, to the Commissioner of Taxation.

B) The portion of net profits attributable to the City of Oregon of a business, profession, enterprise or other

activity.

1.

NATURE OF BUSINESS: ________________________________________________________

2.

Starting date of activities in Oregon (or start date of withholding for an Oregon resident):____________________

3.

Number of employees to be employed in the City of Oregon: _________________________________________

4.

If address shown above is a branch office, show name and address of home office, or vice versa.

__________________________________________________________________________

__________________________________________________________________________

5.

Is withholding done in-house ______, or by a third-party payroll company _________?

If done in-house, our withholding forms can be found on-line at If withholding is less than $200

per month, quarterly withholding can be done. If greater than $200 per month, monthly withholding is required. Your

FEIN serves as your account number.

6.

Type of Business Organization:

________ Corporation

______ Proprietorship

______ Partnership

_______ Other

If business is a Partnership, list names & addresses of Partners ________________________________________

__________________________________________________________________________________________

If you checked “Other” in question 6, please explain the type of organization_________________________________

______________________________________________________________________________________________

7. Date of accounting year-end: ______________________

8. If you are withholding Oregon city tax as a courtesy for employees who do not work in Oregon, but do reside in Oregon,

please check here: ______

I certify the above to be true and correct:

_____________________________________________

_______________________________

(Authorized Representative)

(Title)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1