Sales, Rental/lease, Lodging, Liquor, Use And Wine Tax Report Form - City Of Mountain Brook, Alabama

ADVERTISEMENT

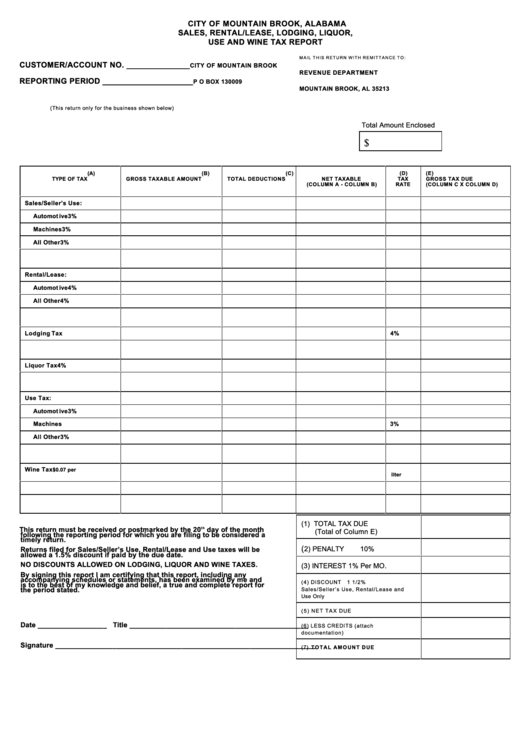

CITY OF MOUNTAIN BROOK, ALABAMA

SALES, RENTAL/LEASE, LODGING, LIQUOR,

USE AND WINE TAX REPORT

M A I L T H I S R E T U R N W IT H R E M IT T A N C E T O :

CUSTOMER/ACCOUNT NO. ______________

CITY OF MOUNTAIN BROOK

REVENUE DEPARTMENT

REPORTING PERIOD ____________________

P O BOX 130009

MOUNTAIN BRO OK, AL 35213

(This return only for the business shown below)

Total Amount Enclosed

$

(A)

(B)

(C)

(D)

(E)

TYPE OF TAX

GROSS TAXABLE AMOUNT

TOTAL DEDUCTIONS

NET TAXABLE

TAX

GROSS TAX DUE

(COLUMN A - COLUMN B)

RATE

(COLUMN C X COLUMN D)

Sales/Seller’s Use:

Automot ive

3%

Machines

3%

All Other

3%

Rental/Lease:

Automot ive

4%

All Other

4%

Lodging Tax

4%

Liquor Tax

4%

Use Tax:

Automot ive

3%

Machines

3%

All Other

3%

Wine Tax

$0.07 per

liter

(1) TOTAL TAX DUE

th

This return must be received or postmarked by the 20

day of the month

(Total of Column E)

following the reporting period for which you are filing to be considered a

timely return.

(

2) PENALTY

10%

Returns filed for Sales/Seller’s Use, Rental/Lease and Use taxes will be

allowed a 1.5% discount if paid by the due date.

NO DISCOUNTS ALLOWED ON LODGING, LIQUOR AND WINE TAXES.

(3) INTEREST 1% Per MO.

By signing this report I am certifying that this report, including any

accompanying schedules or statements, has been examined by me and

(4) DISCOUNT

1 1/2%

is to the best of my knowledge and belief, a true and complete report for

the period stated.

Sales/Seller’s Use, Rental/Lease and

Use O nly

( 5 ) N E T T A X D U E

Date _________________ Title ____________________________________________

(6) LESS CRED ITS (attach

documentation)

Signature ________________________________________________________________

(7) T O T A L A M O U N T D U E

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3