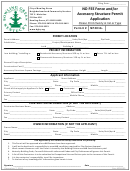

Business License / Accommodations Tax And Beach Preservation Fee Permit/application Form - Town Of Hilton Head Island Page 3

ADVERTISEMENT

APPLICATION /PERMIT CHECKLIST

Please ensure you have attached all the required documents when submitting your

application. After 30 days, incomplete applications will be returned by mail and if you are

found operating without a valid business license, you may be subject to fines up to a $1092.50

per day and if applicable, liens may be placed on properties for the collection of fees, taxes, penalties and collection costs.

Accommodation/Beach Fee Account Permit Only: Section A:

1. If your property is titled in the name of a Trust or business, it must be registered with the South Carolina Secretary of State

❒ Attached

and/or Department of Revenue and you must provide a copy of the certificate along with the application.

2. Copy of business registration documents and list of officers or members. For example: Articles of Incorporation

❒ Attached ❒N/A

and a list of officers or for Limited Liability companies/partnerships, a list of members, particularly, the

managing member.

❒ Attached

3. $10.00 Non-Refundable application fee

(Checks payable to the Town of Hilton Head Island)

Business License Application: Section B:

❒ Attached

1. Proof that the business has registered with the South Carolina Secretary of State and/or Department of Revenue.

2. Copy of business registration documents and list of officers or members. For example: Articles of Incorporation

❒ Attached ❒N/A

and a list of officers or for Limited Liability companies/partnerships, a list of members, particularly, the

managing member.

❒ Attached ❒N/A

3. Professional/Contractors License (when applicable)

❒ Attached

4. $10.00 Non-Refundable application fee

(Checks payable to the Town of Hilton Head Island)

5. The application must be signed by a principal of the company. If the principal cannot present the application in

person, the agent should provide written authorization from the owner/principal.

A Corporation: signed by an officer

An LLC or LLP: signed by a managing member

All others must be signed by an owner.

❒ Attached ❒N/A

6. If you are a residential rental property owner and have owned/rented the properties in prior years, please

provide copies of the last three years tax returns, documenting the gross rents you received.

(i.e. 1040 Schedule E, 1040 Schedule C, 1065, 1120, 1120S or 8825 which would accompany Form 1065, 1065-B or 1120S)

Section C:

In Town businesses, before obtaining a business license we recommend obtaining the following pre approvals:

APPLICATION APPROVALS

1.

Business has a physical location within Town limits:

Community Development (Planning):

Fire and Rescue (Addressing):

Name: ______________________________

Name: ______________________________

Signature: ___________________________ Date: _________

Signature: ___________________________ Date: _________

❒ Required License Type:_____________________________

2.

Community Development (Contractor License Verification):

❒ Not Required

Name: ________________________________________________

Signature: ___________________________ Date: _________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3