Survivor Benefits

If a member dies prior to retirement, eligible survivors are entitled to a monthly survivor benefit. Pursuant to

NRS 286.671, eligible survivors are the member’s spouse or registered domestic partner or Survivor

Beneficiary and Additional Payees. In addition, dependent children under the age of 18 at the time of the

member’s death would also be eligible for a benefit. In order for the Survivor Beneficiary and Additional

Payees to receive benefits, the member must be unmarried at the time of death. To qualify for survivor benefits,

the member must have:

1. Two years of service in the two and one-half years immediately preceding the member’s death;

2. Ten or more years of accredited service; or

3. Died as a result of an occupational disease or as a result of an accident arising out of or in the course of

employment, regardless of service credit.

The calculation of benefits for the spouse or registered domestic partner or the Survivor Beneficiary and

Additional Payees is based on the number of years of service credit the member had at the time of death. If the

member had less than 10 years of service credit, the benefit would be $450.00 paid to the spouse or registered

domestic partner split between the Survivor Beneficiary and the Additional Payees based on the designated

percentage.

If the member had more than 10 years of service credit but less than 15 years, the benefit would be paid under

Option 3, which is calculated based on the member’s age at the time of death, the spouse’s or registered

domestic partner’s or Survivor Beneficiary’s age, member’s service credit, and average compensation. A flat

rate monthly benefit of $450.00 could be substituted for the Option 3 benefit, depending on which is greater.

If the member had more than 15 years of service credit or was fully eligible to retire, the benefit would be paid

under Option 2, which is calculated based on the member’s age at the time of death, the spouse’s or registered

domestic partner’s or Survivor Beneficiary’s age, member’s service credit, and average compensation. A flat

rate monthly benefit of $450.00 could be substituted for the Option 2 benefit, depending on which is greater.

Dependent children under the age of 18 at the time of the member’s death, who were the issue of or legally

adopted children of the member, are entitled to a monthly benefit of $400.00 per month until the child reaches

age 18. Once the child reaches age 18, he/she must be a continuous full-time student to receive benefits until

age 23.

Benefits cease upon death of the Survivor Beneficiary. Therefore, if the System was paying benefits to a

Survivor Beneficiary and Additional Payees, when the Survivor Beneficiary dies, payments to the Additional

Payees would cease as well. If an Additional Payee dies, the benefit amount would be redistributed among the

remaining payees.

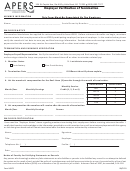

The designation of the Survivor Beneficiary and the Additional Payees must be made on the PERS’ form

entitled Survivor Beneficiary Designation. Your Survivor Beneficiary and Additional Payees will receive

payment based on the percentages you designated for the lifetime of the Survivor Beneficiary. The form

must be properly completed and be submitted or postmarked with a date prior to the member’s death.

In the event the member fails to meet eligibility requirements for survivor benefits prior to death, a lump-sum

refund of any employee contributions would be paid to the member’s spouse or registered domestic partner. If

no spouse or registered domestic partner exists the refund would be paid to the listed Survivor

Beneficiary/Additional Payees. If there are no listed Survivor Beneficiary/Additional Payees the refund would

be paid to the listed Tertiary Beneficiary/ies. If there are no listed Tertiary Beneficiary/ies the refund would be

paid to the member’s estate. If there is no estate, the refund would be paid to the member’s heirs.

If you have additional questions, please contact us at (775) 687-4200, (702) 486-3900 or toll-free 1-866-473-

7768.

1

1 2

2