Form L-Np - Net Profit Tax Return For Businesses 2005 - City Of Lakewood

ADVERTISEMENT

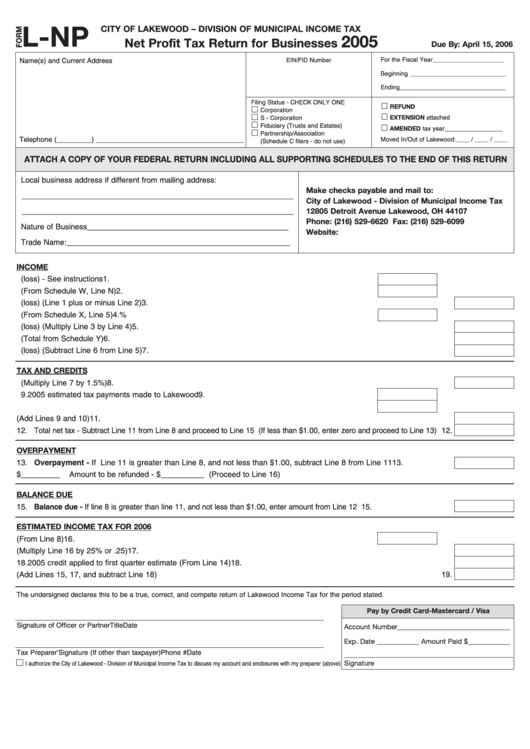

CITY OF LAKEWOOD – DIVISION OF MUNICIPAL INCOME TAX

L-NP

2005

Net Profit Tax Return for Businesses

Due By: April 15, 2006

For the Fiscal Year _____________________

Name(s) and Current Address

EIN/FID Number

Beginning ____________________________

Ending _______________________________

Filing Status - CHECK ONLY ONE

REFUND

Corporation

EXTENSION attached

S - Corporation

Fiduciary (Trusts and Estates)

AMENDED tax year _________________

Partnership/Association

Telephone (_________) ______________________________________

Moved In/Out of Lakewood: ____ / ____ / ____

(Schedule C filers - do not use)

ATTACH A COPY OF YOUR FEDERAL RETURN INCLUDING ALL SUPPORTING SCHEDULES TO THE END OF THIS RETURN

Local business address if different from mailing address:

Make checks payable and mail to:

_______________________________________________________________________

City of Lakewood - Division of Municipal Income Tax

_______________________________________________________________________

12805 Detroit Avenue Lakewood, OH 44107

Phone: (216) 529-6620 Fax: (216) 529-6099

Nature of Business ______________________________________________

Website:

Trade Name: ___________________________________________________

INCOME

1. Total taxable Federal income (loss) - See instructions

1.

2. Net adjustments (From Schedule W, Line N)

2.

3. Adjusted taxable income (loss) (Line 1 plus or minus Line 2)

3.

4. Allocation percentage (From Schedule X, Line 5)

4.

%

5. Adjusted net income (loss) (Multiply Line 3 by Line 4)

5.

6. Loss carried forward from previous years (Total from Schedule Y)

6.

7. Lakewood taxable income (loss) (Subtract Line 6 from Line 5)

7.

TAX AND CREDITS

8. Lakewood tax due before credits (Multiply Line 7 by 1.5%)

8.

9. 2005 estimated tax payments made to Lakewood

9.

10. Income tax credit carried forward from prior years

10.

11. Total tax payments and credits (Add Lines 9 and 10)

11.

12. Total net tax - Subtract Line 11 from Line 8 and proceed to Line 15 (If less than $1.00, enter zero and proceed to Line 13) 12.

OVERPAYMENT

13. Overpayment - If Line 11 is greater than Line 8, and not less than $1.00, subtract Line 8 from Line 11

13.

14. From Line 13 - Amount to be credited - $_________

Amount to be refunded - $__________ (Proceed to Line 16)

BALANCE DUE

15. Balance due - If line 8 is greater than line 11, and not less than $1.00, enter amount from Line 12

15.

ESTIMATED INCOME TAX FOR 2006

16. Estimated income tax for 2006 (From Line 8)

16.

17. First quarter estimate (Multiply Line 16 by 25% or .25)

17.

18. 2005 credit applied to first quarter estimate (From Line 14)

18.

19. Total amount due - (Add Lines 15, 17, and subtract Line 18)

19.

The undersigned declares this to be a true, correct, and compete return of Lakewood Income Tax for the period stated.

Pay by Credit Card-Mastercard / Visa

Signature of Officer or Partner

Title

Date

Account Number ________________________________

Exp. Date ____________ Amount Paid $ ____________

Tax Preparer’ Signature (If other than taxpayer)

Phone #

Date

________________________________________________

Signature

I authorize the City of Lakewood - Division of Municipal Income Tax to discuss my account and enclosures with my preparer (above)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2