Form Lo 403.5 Request For Rate Based On Weeks Of Employment

ADVERTISEMENT

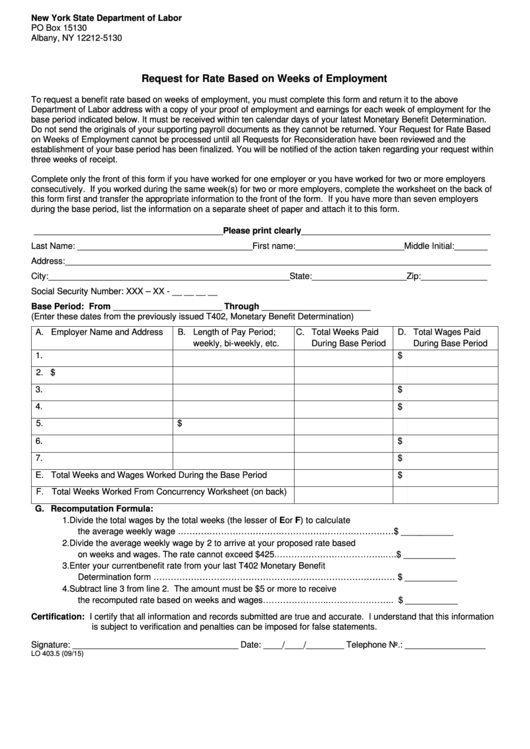

New York State Department of Labor

PO Box 15130

Albany, NY 12212-5130

Request for Rate Based on Weeks of Employment

To request a benefit rate based on weeks of employment, you must complete this form and return it to the above

Department of Labor address with a copy of your proof of employment and earnings for each week of employment for the

base period indicated below. It must be received within ten calendar days of your latest Monetary Benefit Determination.

Do not send the originals of your supporting payroll documents as they cannot be returned. Your Request for Rate Based

on Weeks of Employment cannot be processed until all Requests for Reconsideration have been reviewed and the

establishment of your base period has been finalized. You will be notified of the action taken regarding your request within

three weeks of receipt.

Complete only the front of this form if you have worked for one employer or you have worked for two or more employers

consecutively. If you worked during the same week(s) for two or more employers, complete the worksheet on the back of

this form first and transfer the appropriate information to the front of the form. If you have more than seven employers

during the base period, list the information on a separate sheet of paper and attach it to this form.

________________________________________Please print clearly________________________________________

Last Name: _____________________________________First name:_______________________Middle Initial:_______

Address:__________________________________________________________________________________________

City:___________________________________________________State:____________________Zip:______________

Social Security Number: XXX – XX - __ __ __ __

Base Period: From _______________________ Through _______________________

(Enter these dates from the previously issued T402, Monetary Benefit Determination)

A. Employer Name and Address

B. Length of Pay Period; i.e.

C. Total Weeks Paid

D. Total Wages Paid

weekly, bi-weekly, etc.

During Base Period

During Base Period

1.

$

2.

$

3.

$

4.

$

5.

$

6.

$

7.

$

E. Total Weeks and Wages Worked During the Base Period

$

F. Total Weeks Worked From Concurrency Worksheet (on back)

G. Recomputation Formula:

1. Divide the total wages by the total weeks (the lesser of E or F) to calculate

the average weekly wage …………………………………………………………………$ ___________

2. Divide the average weekly wage by 2 to arrive at your proposed rate based

on weeks and wages. The rate cannot exceed $425.………………………………..….$ ___________

3. Enter your current benefit rate from your last T402 Monetary Benefit

Determination form ………………………………………………………………………… $ ___________

4. Subtract line 3 from line 2. The amount must be $5 or more to receive

the recomputed rate based on weeks and wages…………………..………………….. $ ___________

Certification: I certify that all information and records submitted are true and accurate. I understand that this information

is subject to verification and penalties can be imposed for false statements.

Signature: ___________________________________ Date: ____/____/________ Telephone No.: _________________

LO 403.5 (09/15)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2