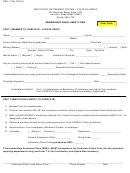

Name: _____________________________________________

Reinstatement to a former membership in accordance with Section 645 (Tiers 3, 4, 5 and 6).

Note: Completion of this form does not constitute an application for reinstatement.

Section 645 of the Retirement and Social Security Law allows members of a New York State public retirement system, whose original

membership was terminated or withdrawn, to return to their former Tier or date of membership.

Members with a former Tier 3, 4, 5 or 6 membership in the New York State and Local Employees’ Retirement System will be automatically

provided with the cost, if any, and procedures for reinstatement at a later date.

Former Tier 3, 4, 5 or 6 members of any NYS public retirement system, other than the NYS Employees’ Retirement System, please

complete the section below. We will provide you with the cost, if any, and procedures for reinstatement at a later date.

Reinstatement to a former membership in accordance with Section 645 (Tiers 1 and 2).

Members with a former Tier 1 or 2 membership in any New York public retirement system may apply for reinstatement by completing the

section below.

Important Information:

If you are not sure of your employer’s current Tier 1 or 2 retirement plan, or if you are a member of the Police and Fire Retirement System

or if you have any questions regarding reinstatement you should contact the Retirement System before completing the section below.

If you are given Tier 1 or 2 status, your Tier 3, 4, 5 or 6 contributions are not refundable and you will not be able to take a loan against

these contributions.

If your date of membership will be before April 1, 1960, you may owe contributions for services rendered prior to April 1, 1960. Any deficit

in contributions for service before the date noted will result in a reduction of your retirement benefit.

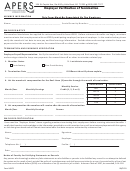

FORMER MEMBERSHIP INFORMATION:

PLEASE CHECK THE FIRST FORMER RETIREMENT SYSTEM YOU WERE A MEMBER OF:

New York State Teachers’ Retirement System

New York City Board of Education Retirement System

New York State and Local Employees’ Retirement System

New York City Teachers’ Retirement System

New York State and Local Police and Fire Retirement System

New York City Police Pension Fund

New York City Employees’ Retirement System

New York City Fire Pension Fund

PLEASE COMPLETE THE FOLLOWING (if known):

Former Registration Number:_________________________________________

Date of Membership: __________________

Former Name (if applicable): _______________________________________________________________________________

Have you received credit for this former membership in any other retirement system? Yes

No

If Yes, what retirement system?______________________________________________________________________________

Are you receiving or eligible to receive a retirement benefit based on this ser vice?

Yes

No

Signature __________________________________________________________ Date _________________________________

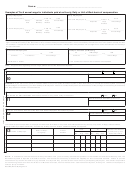

If you are eligible for a refund of contributions, the Retirement System is required to withhold 10% of the taxable amount of the refund for

federal taxes unless you instruct us not to take the withholding.

If you do not want the Retirement System to withhold federal income tax from your payment, sign and date this election.

I DO NOT WANT TO HAVE FEDERAL INCOME TAX WITHHELD FROM MY PAYMENT.

Signed:_______________________________________________________________

Date: _________________________________

RS 5420 (Rev. 5/16) Page 3 of 4

1

1 2

2 3

3 4

4