Form St-Ch-1 - Application For Certificate Of Exemption For Nonprofit Child - Departament Of Revenue, State Of Georgia

ADVERTISEMENT

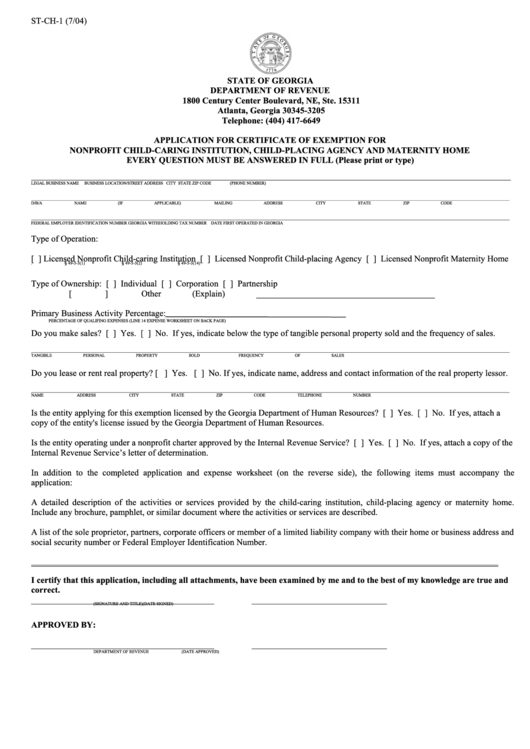

ST-CH-1 (7/04)

STATE OF GEORGIA

DEPARTMENT OF REVENUE

1800 Century Center Boulevard, NE, Ste. 15311

Atlanta, Georgia 30345-3205

Telephone: (404) 417-6649

APPLICATION FOR CERTIFICATE OF EXEMPTION FOR

NONPROFIT CHILD-CARING INSTITUTION, CHILD-PLACING AGENCY AND MATERNITY HOME

EVERY QUESTION MUST BE ANSWERED IN FULL (Please print or type)

_______________________________________________________________________________________________________________________________________

LEGAL BUSINESS NAME

BUSINESS LOCATION/STREET ADDRESS

CITY

STATE

ZIP CODE

(PHONE NUMBER)

________________________________________________________________________________________________________________________________________________________________________________________________________________________

D/B/A NAME (IF APPLICABLE)

MAILING ADDRESS

CITY

STATE

ZIP CODE

________________________________________________________________________________________________________________________________________________________________________________________________________________________

FEDERAL EMPLOYER IDENTIFICATION NUMBER

GEORGIA WITHHOLDING TAX NUMBER

DATE FIRST OPERATED IN GEORGIA

Type of Operation:

[ ] Licensed Nonprofit Child-caring Institution [ ] Licensed Nonprofit Child-placing Agency [ ] Licensed Nonprofit Maternity Home

O.C.G.A. § 49-5-3(1)

O.C.G.A. § 49-5-3(2)

O.C.G.A. § 49-5-3(14)

.

Type of Ownership:

[ ] Individual

[ ] Corporation

[ ] Partnership

[ ] Other (Explain) _________________________________________

Primary Business Activity Percentage:

PERCENTAGE OF QUALIFING EXPENSES (LINE 14 EXPENSE WORKSHEET ON BACK PAGE)

Do you make sales? [ ] Yes. [ ] No. If yes, indicate below the type of tangible personal property sold and the frequency of sales.

________________________________________________________________________________________________________________________________________________________________________________________________________________________

TANGIBLE PERSONAL PROPERTY SOLD

FREQUENCY OF SALES

Do you lease or rent real property? [ ] Yes. [ ] No. If yes, indicate name, address and contact information of the real property lessor.

________________________________________________________________________________________________________________________________________________________________________________________________________________________

NAME

ADDRESS

CITY

STATE

ZIP CODE

TELEPHONE NUMBER

Is the entity applying for this exemption licensed by the Georgia Department of Human Resources? [ ] Yes. [ ] No. If yes, attach a

copy of the entity's license issued by the Georgia Department of Human Resources.

Is the entity operating under a nonprofit charter approved by the Internal Revenue Service? [ ] Yes. [ ] No. If yes, attach a copy of the

Internal Revenue Service’s letter of determination.

In addition to the completed application and expense worksheet (on the reverse side), the following items must accompany the

application:

A detailed description of the activities or services provided by the child-caring institution, child-placing agency or maternity home.

Include any brochure, pamphlet, or similar document where the activities or services are described.

A list of the sole proprietor, partners, corporate officers or member of a limited liability company with their home or business address and

social security number or Federal Employer Identification Number.

I certify that this application, including all attachments, have been examined by me and to the best of my knowledge are true and

correct.

__________________________________________

_______________________________

(SIGNATURE AND TITLE)

(DATE SIGNED)

APPROVED BY:

__________________________________________

_______________________________

DEPARTMENT OF REVENUE

(DATE APPROVED)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2